Caribbean ?

So it was 4 damned degrees this morning — that is straight up Fahrenheit, no wind chill — and there is another storm coming...

> Back on the Kudlow Report at 7:00 pm this evening with the usual crowd. We will be discussing the Markets, Obama, and Inflation....

> Back on the Kudlow Report at 7:00 pm this evening with the usual crowd. We will be discussing the Markets, Obama, and Inflation....

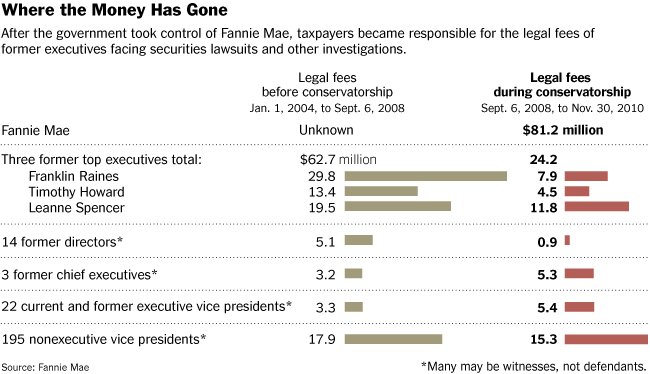

No surprise here: “Since the government took over Fannie Mae and Freddie Mac, taxpayers have spent more than $160 million defending...

No surprise here: “Since the government took over Fannie Mae and Freddie Mac, taxpayers have spent more than $160 million defending...

Its amazing that Keith Richards and George Bush have the #1 & 2 non-fiction NYT best sellers at the same time. One is the story of a...

Its amazing that Keith Richards and George Bush have the #1 & 2 non-fiction NYT best sellers at the same time. One is the story of a...

I frequently discuss the 1966-1982 market cycle, with its cyclical bull and bear markets within the broader context of a longer secular...

I frequently discuss the 1966-1982 market cycle, with its cyclical bull and bear markets within the broader context of a longer secular...

Get subscriber-only insights and news delivered by Barry every two weeks.