Seven Lessons from Doug Kass

This post originally appeared on RealMoney Silver on Jan. 21 at 7:41 a.m. EST. ~~~ Doug put together a list of his lessons learned this...

Last weekend, we showed the incredibly expensive turntable from Avid. This week, something more minimalist is in order: The Turnstyle...

Last weekend, we showed the incredibly expensive turntable from Avid. This week, something more minimalist is in order: The Turnstyle...

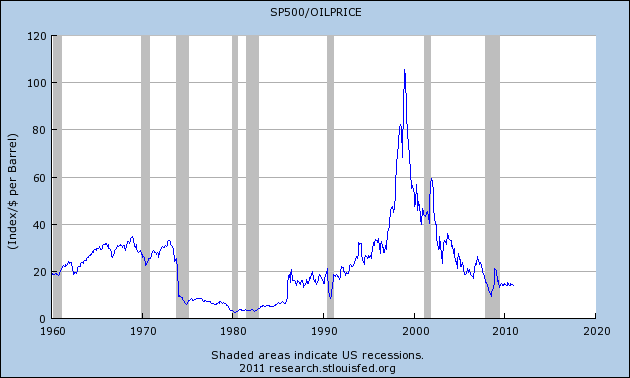

I’ve been wondering recently at what point the price of oil might have the potential to impede the advance of the S&P 500,...

I’ve been wondering recently at what point the price of oil might have the potential to impede the advance of the S&P 500,...

Global Macro Monitor produces informed opinion about markets and the global economy. This was originally published on January 21, 2011....

Global Macro Monitor produces informed opinion about markets and the global economy. This was originally published on January 21, 2011....

“The Chinese delegation has said all week that there will be double-digit growth for years to come and the Brits have lapped it up. But...

“The Chinese delegation has said all week that there will be double-digit growth for years to come and the Brits have lapped it up. But...

> Nice mention in Alan Abelson’s Barron’s column this week: “OUR UNEASE ABOUT THE STOCK MARKET and, to a lesser...

> Nice mention in Alan Abelson’s Barron’s column this week: “OUR UNEASE ABOUT THE STOCK MARKET and, to a lesser...

Get subscriber-only insights and news delivered by Barry every two weeks.