Outsourcing Aircraft Maintenance to the Lowest Bidder

Outsourcing important safety and maintenance operations to the lowest bidder (See also Flying Cheap) Who’s Fixing Your Plane ~~~...

> Tonite I will be on Fast Money on CNBC at 5:15pm discussing the market cionvulsions and where we are in the overall cycle. ~~~...

> Tonite I will be on Fast Money on CNBC at 5:15pm discussing the market cionvulsions and where we are in the overall cycle. ~~~...

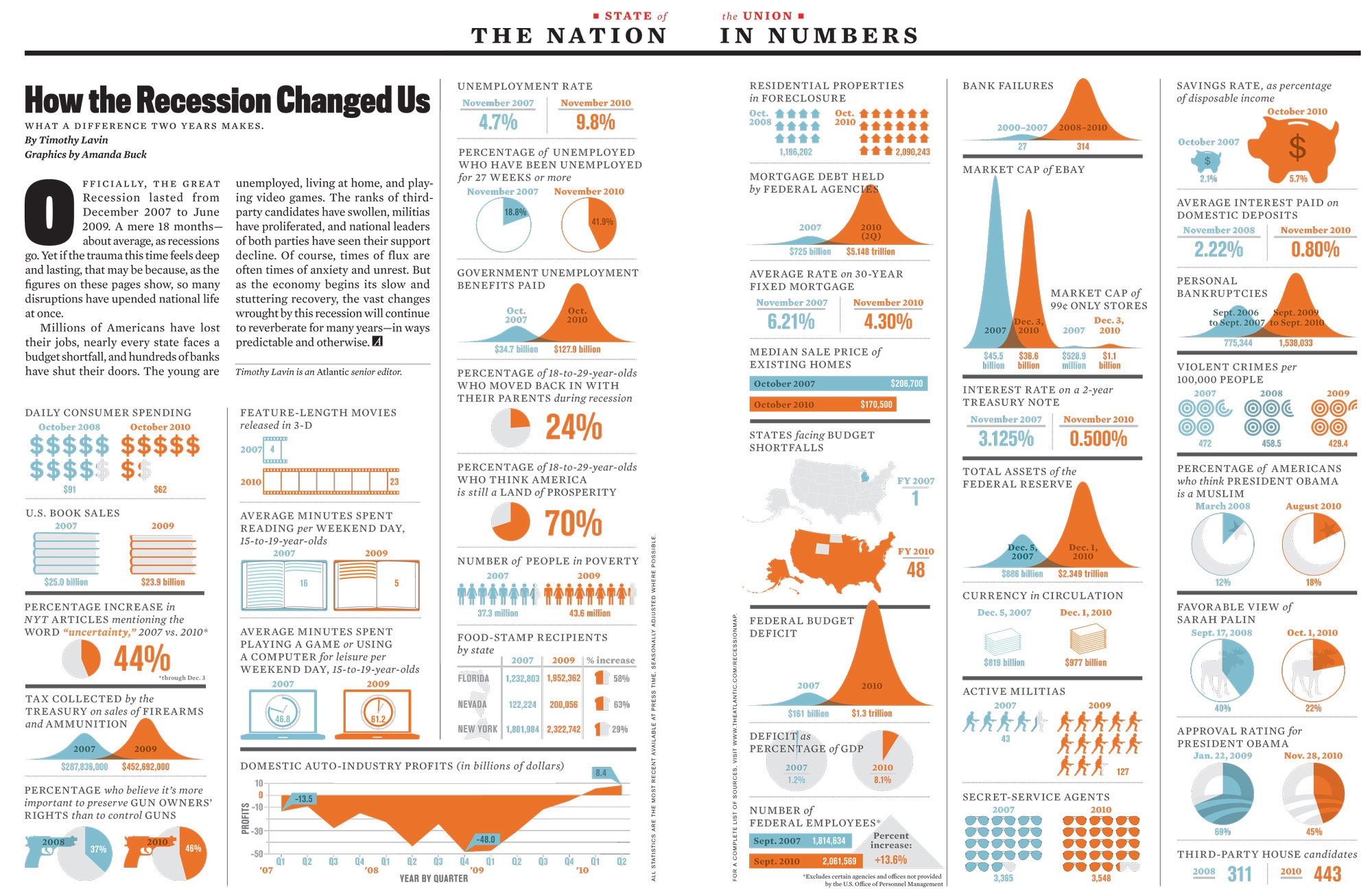

Awesome chartporn from the Atlantic showing the changes in the US wrought by the credit crisis and Great Recession: > click for truly...

Awesome chartporn from the Atlantic showing the changes in the US wrought by the credit crisis and Great Recession: > click for truly...

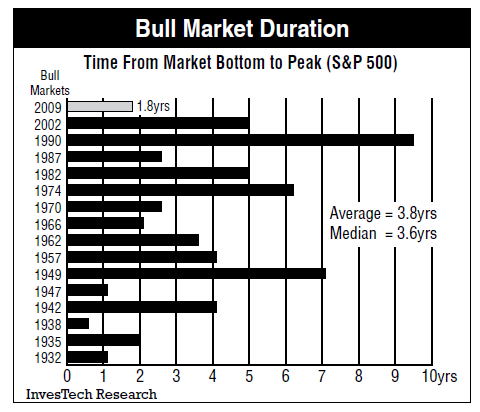

I was speaking with a friend who asked why 48% — why not 100% cash? The short answer is that we are seeing some signs of a...

I was speaking with a friend who asked why 48% — why not 100% cash? The short answer is that we are seeing some signs of a...

Get subscriber-only insights and news delivered by Barry every two weeks.