Inflation unsettling markets

Inflation and the possible responses to it are what’s impacting markets today. It started in China when Q4 GDP was released with a...

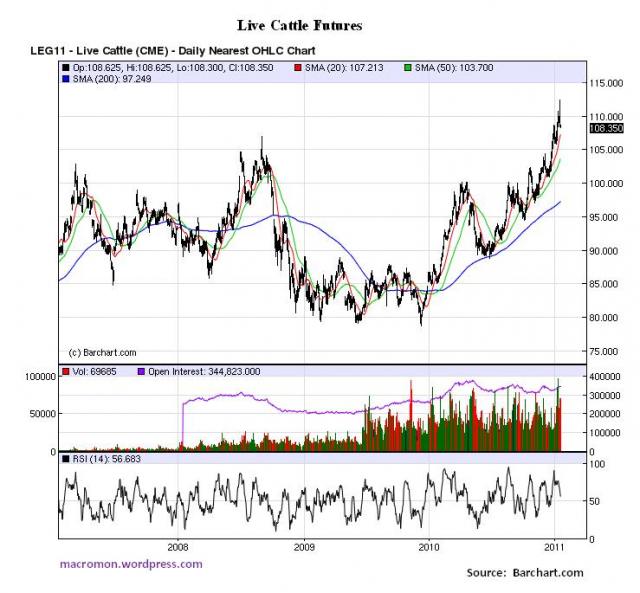

MacroMan points out that Live Cattle Futures have gone parabolic; Daniel Dicker blames speculative derivative traders and a lack of...

MacroMan points out that Live Cattle Futures have gone parabolic; Daniel Dicker blames speculative derivative traders and a lack of...

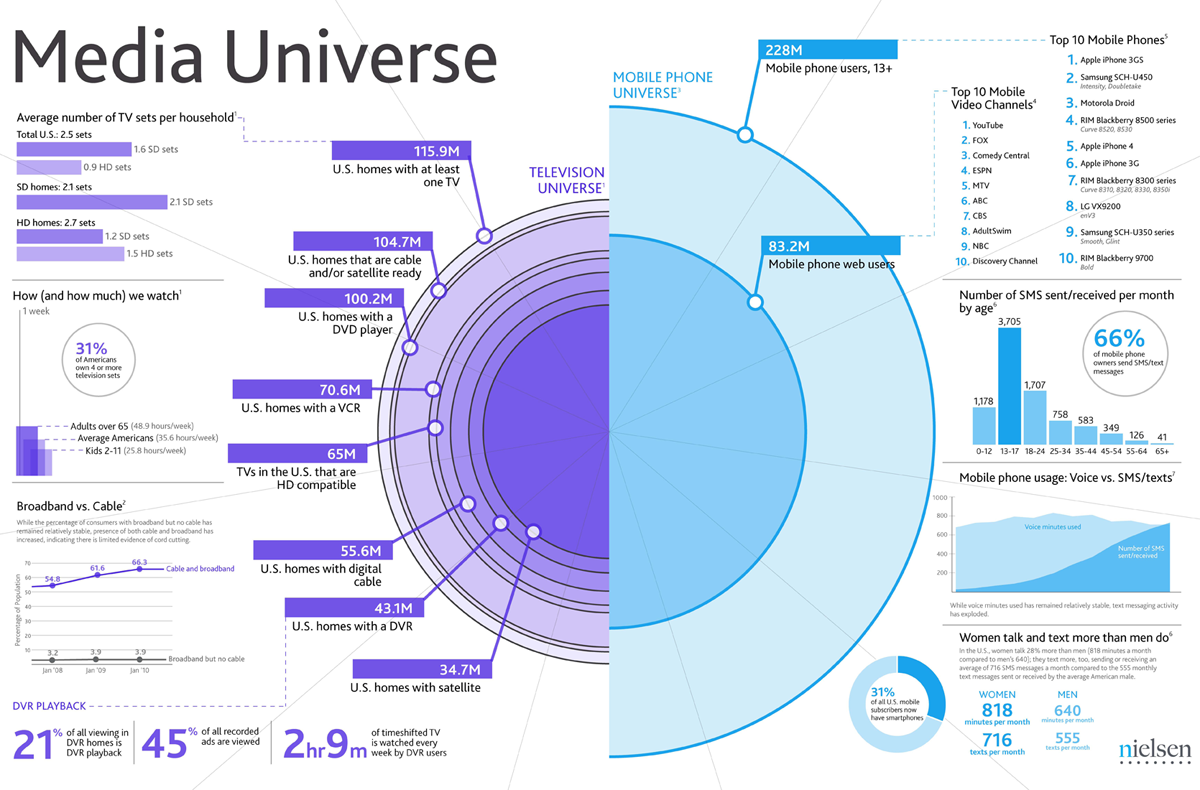

As a follow up to our recent Apple / Blog posts, enjoy this lovely NielsenWire/Factsheet chart porn on The U.S. Media Universe > click...

As a follow up to our recent Apple / Blog posts, enjoy this lovely NielsenWire/Factsheet chart porn on The U.S. Media Universe > click...

Get subscriber-only insights and news delivered by Barry every two weeks.