Sentiment indicators from the AAII (individual investors) and Investors Intelligence (newsletter writers) indicate that stock market...

Sentiment indicators from the AAII (individual investors) and Investors Intelligence (newsletter writers) indicate that stock market...

Read More

Today’s reminder of Steve Jobs’s mortality has overshadowed the rush of various news reports related to publishers using the...

Read More

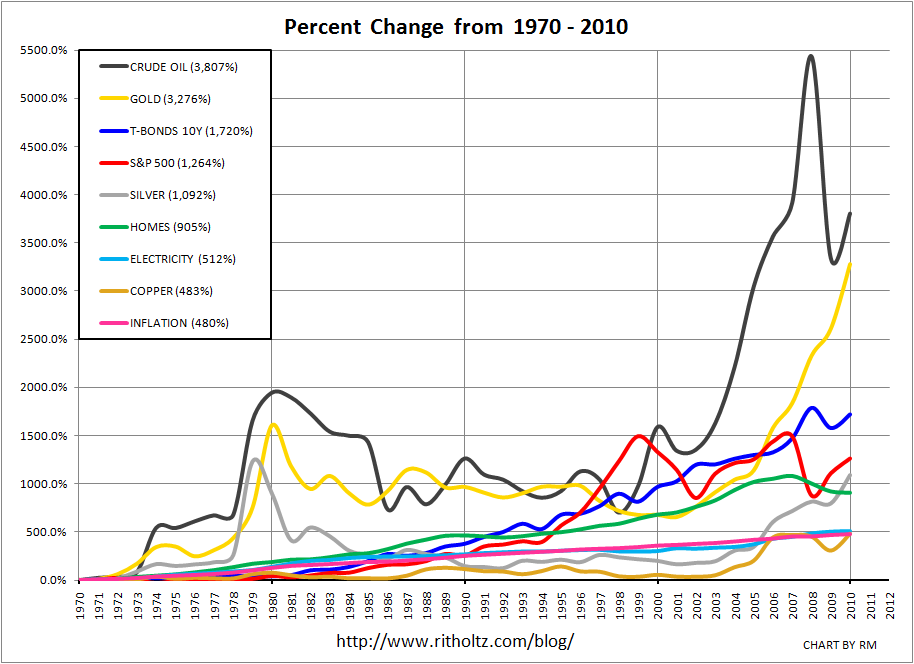

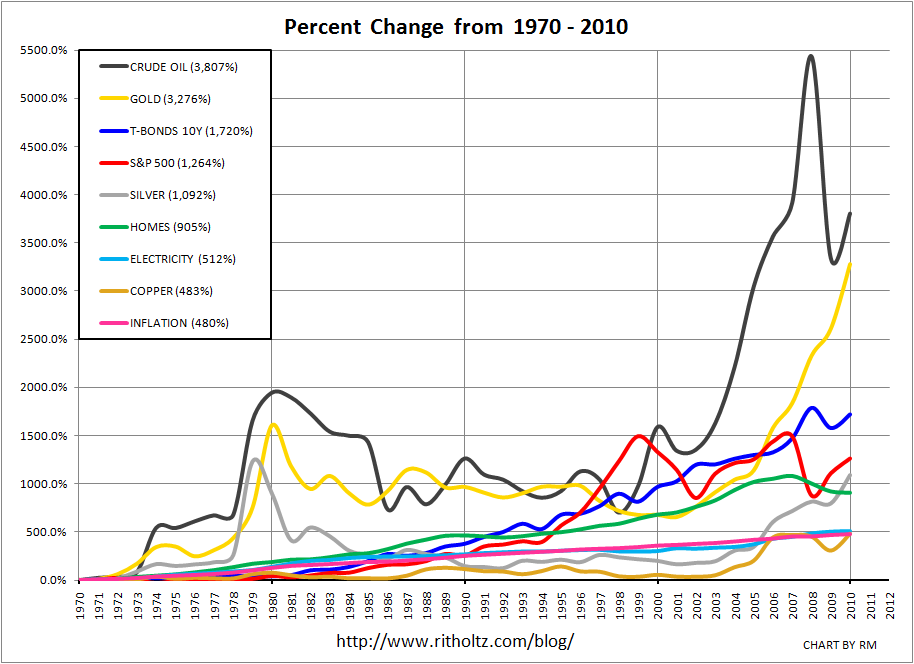

I find I enjoy analyzing equity markets more than any other. But as I have always said, you must always be objective when reviewing the...

I find I enjoy analyzing equity markets more than any other. But as I have always said, you must always be objective when reviewing the...

Read More

I firts showed this back in November 2008. I wanted to show it again — this time using Slideshare, a nice Powerpoint/PDF presented....

Read More

Bill Black is an Associate Professor of Economics and Law at the University of Missouri – Kansas City (UMKC). He was the Executive...

Read More

I am not a vinyl sort of guy, but if I were, this £20,000 limited edition Limited Edition Anniversary Turntable might lead to an ugly...

I am not a vinyl sort of guy, but if I were, this £20,000 limited edition Limited Edition Anniversary Turntable might lead to an ugly...

Read More

I like watching football, but I cannot stand the way the games are televised. On the clock, you have 60 minutes per game, of which there...

Read More

I came down with a bad stomach virus or Food Poisoning yesterdsy — not operating at full strength. The good news is I am 12 pounds...

Read More

By John Mauldin January 15, 2011 > The Fed Adds a Third Mandate A Rational Voice in Dallas Thinking the Unthinkable The Threat of the...

Read More

Sentiment indicators from the AAII (individual investors) and Investors Intelligence (newsletter writers) indicate that stock market...

Sentiment indicators from the AAII (individual investors) and Investors Intelligence (newsletter writers) indicate that stock market...

Sentiment indicators from the AAII (individual investors) and Investors Intelligence (newsletter writers) indicate that stock market...

Sentiment indicators from the AAII (individual investors) and Investors Intelligence (newsletter writers) indicate that stock market...