The stated purpose of quantitative easing was to drive down interest rates on U.S. treasury bonds. But as U.S. News and World Reported...

The stated purpose of quantitative easing was to drive down interest rates on U.S. treasury bonds. But as U.S. News and World Reported...

Read More

> The Brennan JB7 comes very close to a device that I would not only buy, but make the centerpiece of my home audio system. However,...

> The Brennan JB7 comes very close to a device that I would not only buy, but make the centerpiece of my home audio system. However,...

Read More

Barron’s annual roundtable came out this week, with the usual suspects participating. While I tend to be fairly critical of any...

Read More

About 4 months ago, I bought a 500Gig backup drive for $79. This is 4X the storage, for $5 less than what Seagate sells their single...

About 4 months ago, I bought a 500Gig backup drive for $79. This is 4X the storage, for $5 less than what Seagate sells their single...

Read More

Janet Tavakoli is the president of Tavakoli Structured Finance, and has more than 20 years of experience in senior investment banking...

Read More

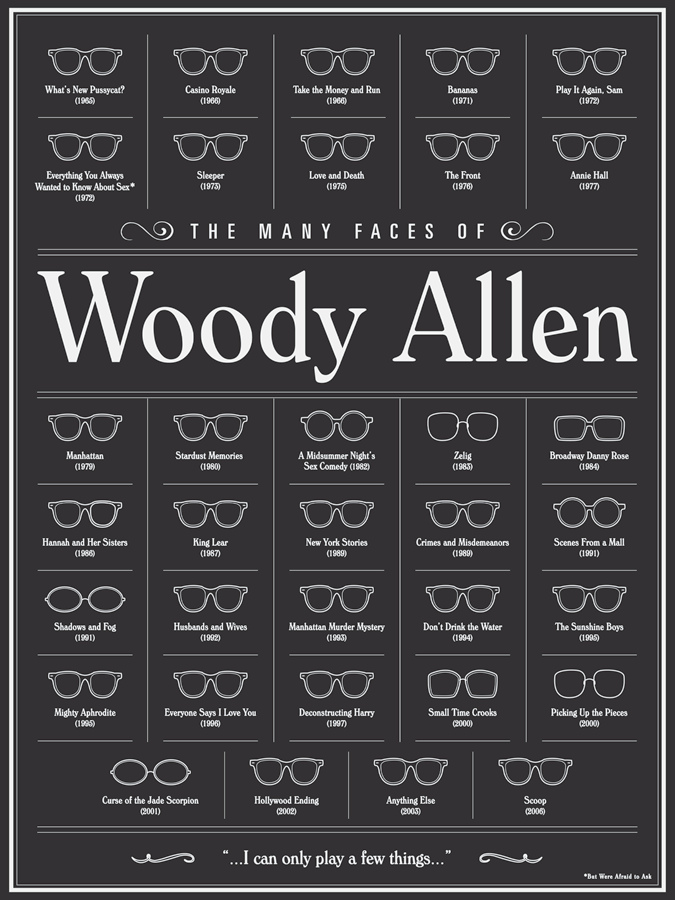

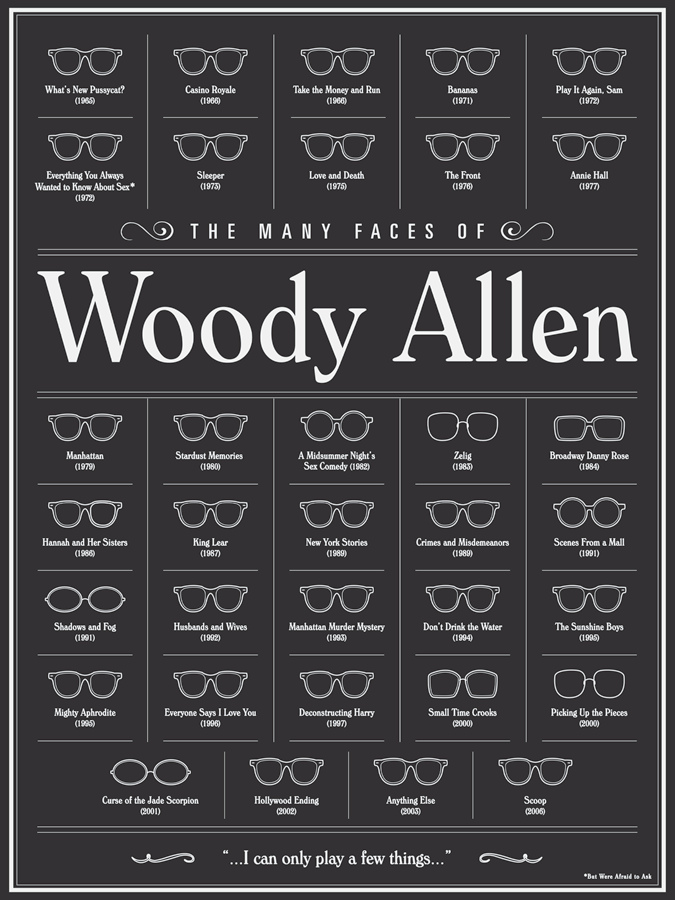

Dunno where I saw this, but it tickled my fancy:

Dunno where I saw this, but it tickled my fancy:

Read More

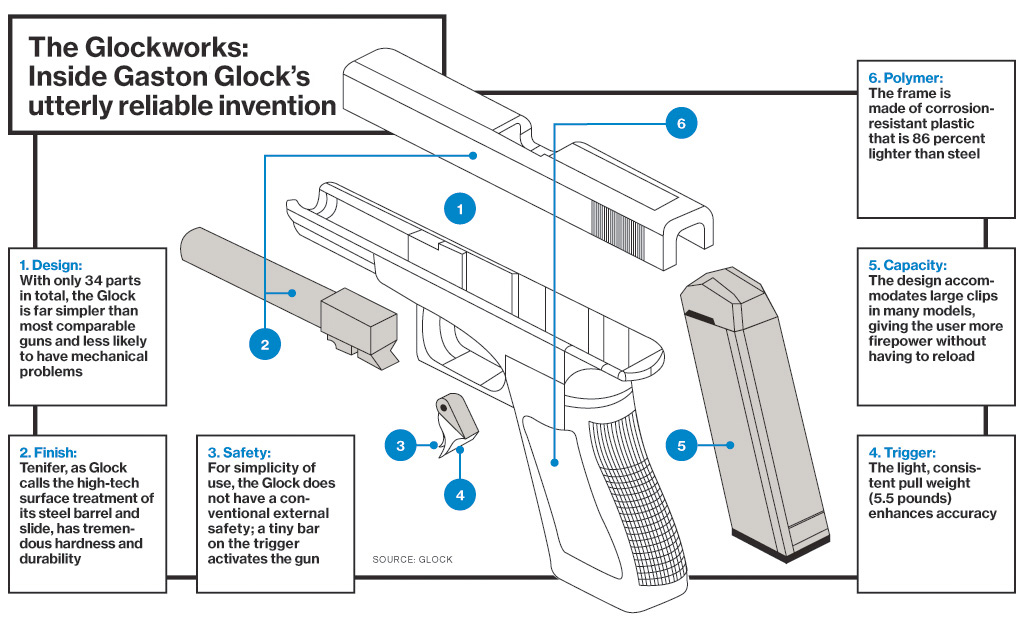

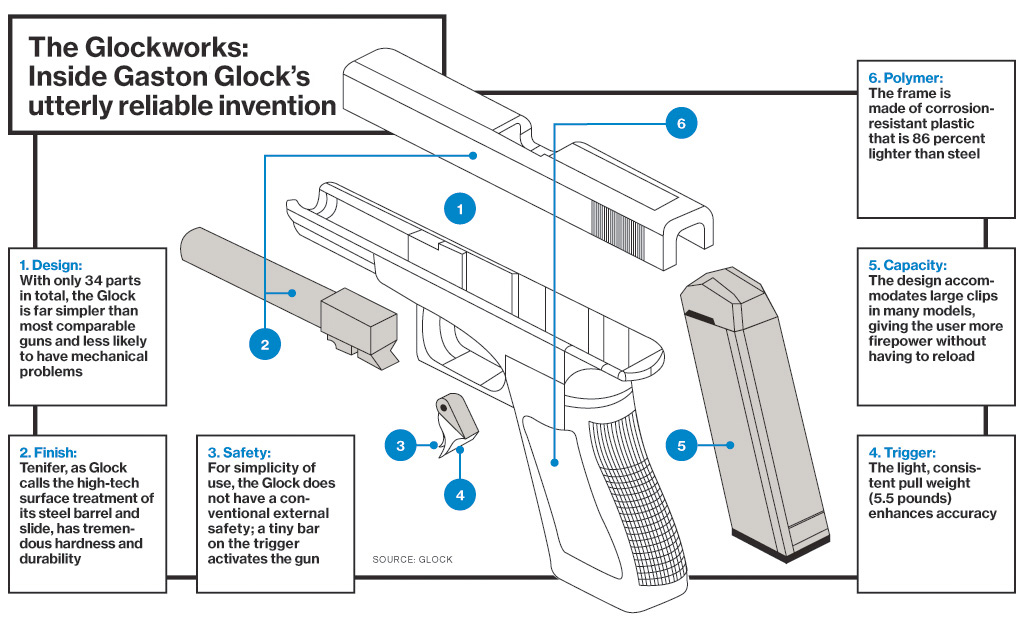

Terrific illustration (from Bloomberg BusinessWeek) as to why the Glock has become America’s favorite handgun. >

Terrific illustration (from Bloomberg BusinessWeek) as to why the Glock has become America’s favorite handgun. >

Read More

~~~ Source: Is the Prius the New Model for Global Good Governance? Daniel Gross Yahoo Tech TickerJan 14, 2011...

Read More

The stated purpose of quantitative easing was to drive down interest rates on U.S. treasury bonds. But as U.S. News and World Reported...

The stated purpose of quantitative easing was to drive down interest rates on U.S. treasury bonds. But as U.S. News and World Reported...

The stated purpose of quantitative easing was to drive down interest rates on U.S. treasury bonds. But as U.S. News and World Reported...

The stated purpose of quantitative easing was to drive down interest rates on U.S. treasury bonds. But as U.S. News and World Reported...