Barron’s Roundtable 2011

Barron’s annual roundtable came out this week, with the usual suspects participating. While I tend to be fairly critical of any...

About 4 months ago, I bought a 500Gig backup drive for $79. This is 4X the storage, for $5 less than what Seagate sells their single...

About 4 months ago, I bought a 500Gig backup drive for $79. This is 4X the storage, for $5 less than what Seagate sells their single...

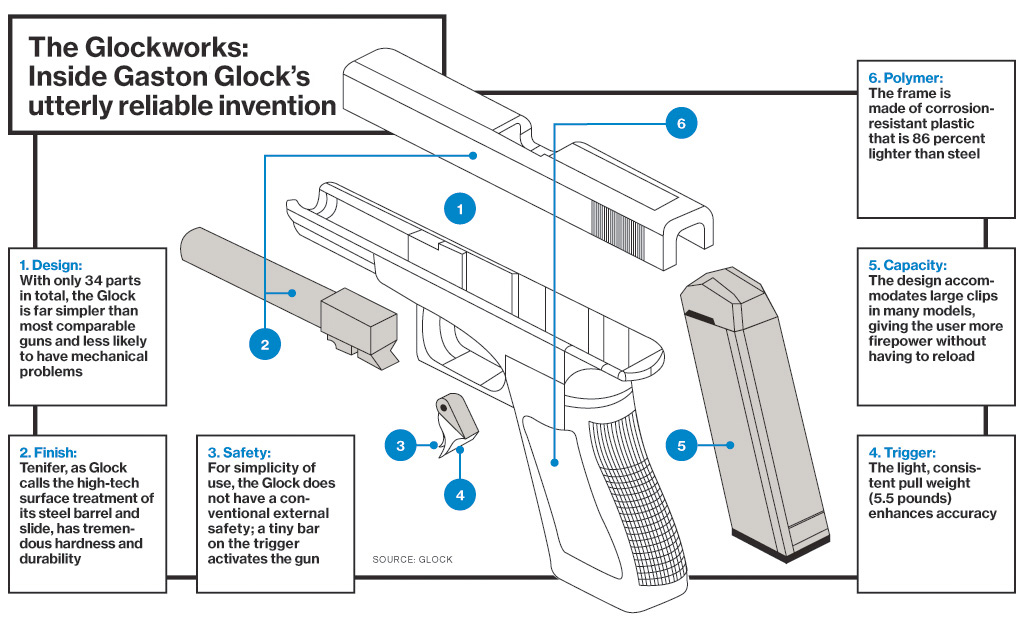

Terrific illustration (from Bloomberg BusinessWeek) as to why the Glock has become America’s favorite handgun. >

Terrific illustration (from Bloomberg BusinessWeek) as to why the Glock has become America’s favorite handgun. >

More from David Rosenberg, who sees the market as heavily propped up by the Fed. This is his expectations for the next year: ~~~...

More from David Rosenberg, who sees the market as heavily propped up by the Fed. This is his expectations for the next year: ~~~...

Get subscriber-only insights and news delivered by Barry every two weeks.