Stephen Roach: Propping Up the Economy

A global perspective on the Fed policy and the economy, with Stephen Roach, Yale University/former Morgan Stanley Asia chairman. Airtime:...

Following the Take Aim post, long time blog reader and North Tucson resident Kevin makes the following suggestion: “Create a way...

Following the Take Aim post, long time blog reader and North Tucson resident Kevin makes the following suggestion: “Create a way...

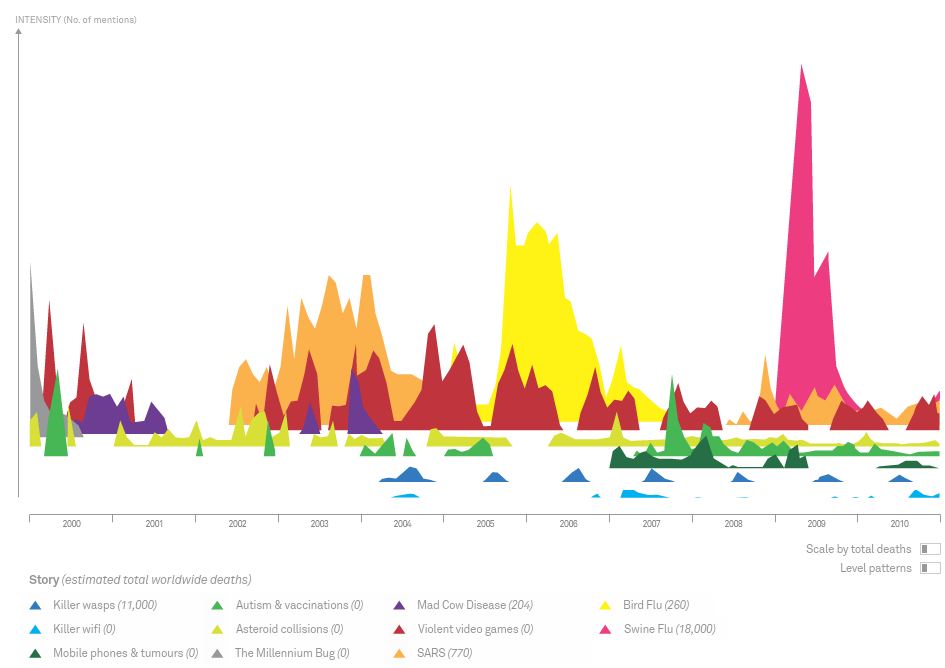

> The chart above, via Information is Beautiful, shows the intention of media mentions of specific deadly “fears,” from...

> The chart above, via Information is Beautiful, shows the intention of media mentions of specific deadly “fears,” from...

CNN reports that John Lennon’s first car, a 1965 Ferrari 330 GT 2+2 Coupe, is up for auction. The car has an estimated value of...

CNN reports that John Lennon’s first car, a 1965 Ferrari 330 GT 2+2 Coupe, is up for auction. The car has an estimated value of...

Get subscriber-only insights and news delivered by Barry every two weeks.