Munger to Goldbugs: ‘You’re Jerks’ (U Michigan 2010)

Munger said he likes good stocks instead of government bonds and he “doesn’t have the slightest interest” in investing...

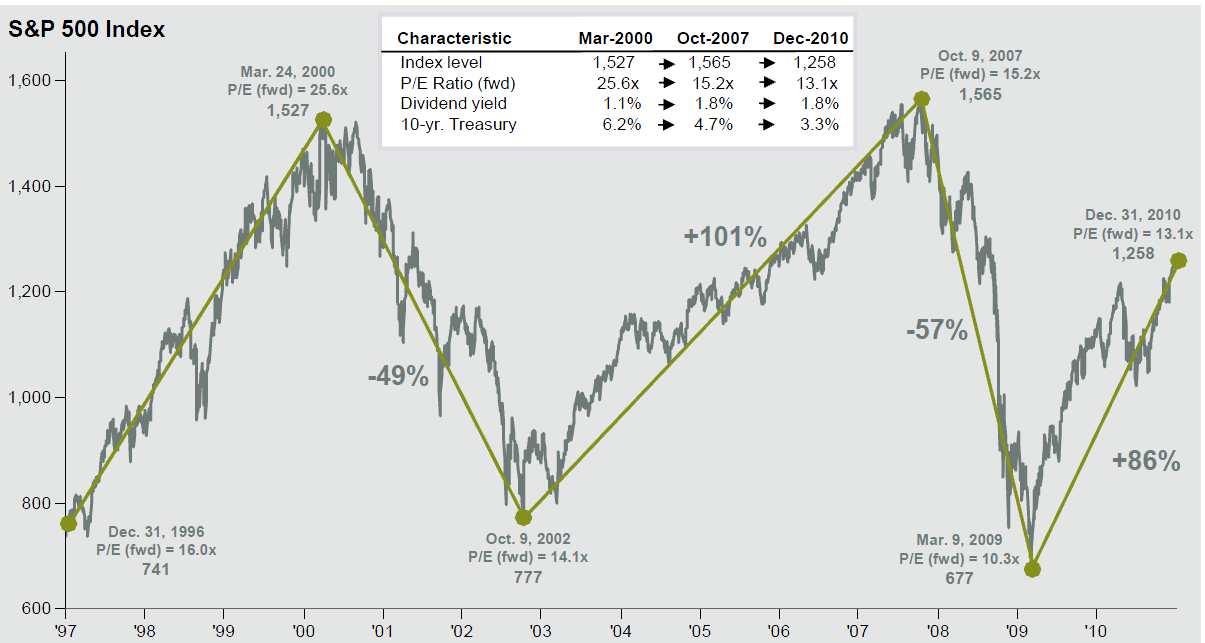

Dr. David P. Kelly, of JP Morgan Asset Management puts out a monthly deck laden with great charts. This chart — the Buy &...

Dr. David P. Kelly, of JP Morgan Asset Management puts out a monthly deck laden with great charts. This chart — the Buy &...

chart courtesy of FusionIQ > As seen in the above chart the trend (green line) remains up for the S&P 500 with minor support in...

chart courtesy of FusionIQ > As seen in the above chart the trend (green line) remains up for the S&P 500 with minor support in...

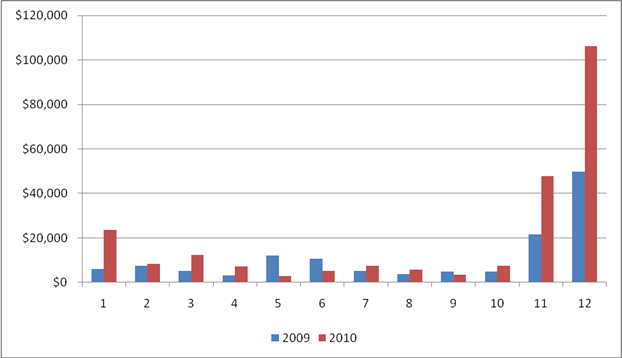

I have mentioned numerous items of interest on the blog over the years: Books, music, movies, myriad art and the occasional craft. While...

I have mentioned numerous items of interest on the blog over the years: Books, music, movies, myriad art and the occasional craft. While...

Get subscriber-only insights and news delivered by Barry every two weeks.