The Bid Abides (48% Cash)

Markets continue to show firmness. There are lots of near term warnings signs that caution is warranted, and a modest correction is...

Global Macro Monitor produces informed opinion about markets and the global economy. This was originally published on January 11, 2011...

Global Macro Monitor produces informed opinion about markets and the global economy. This was originally published on January 11, 2011...

> Tonite I will be on Fast Money on CNBC at 5:00pm discussing Trading, specific tech stocks and the usual. ~~~ UPDATE: Videos will be...

> Tonite I will be on Fast Money on CNBC at 5:00pm discussing Trading, specific tech stocks and the usual. ~~~ UPDATE: Videos will be...

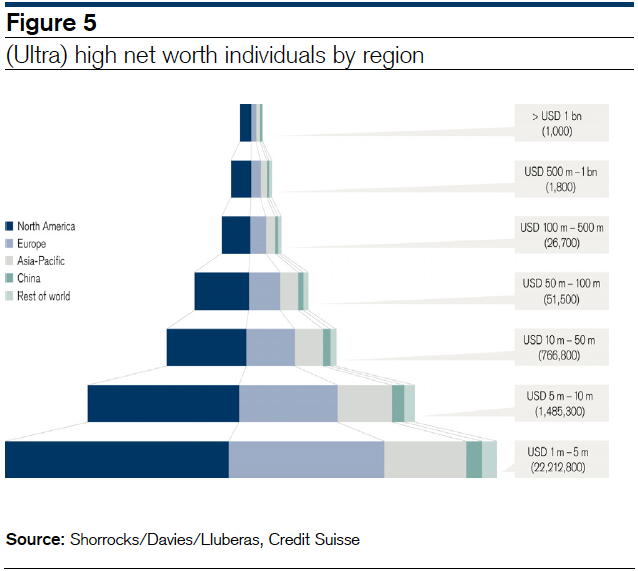

Chrystia Freeland, the FT’s former US Managing Editor and current trophy editor at Reuters, has a cover story in The Atlantic that...

Chrystia Freeland, the FT’s former US Managing Editor and current trophy editor at Reuters, has a cover story in The Atlantic that...

Get subscriber-only insights and news delivered by Barry every two weeks.