Our Political Rhetoric Isn’t Too Violent, It’s...

You could feel the collective cringe pass through atmosphere long before Pima County Sherrif Clarence Dupnik condemned the level of...

I have been saying that the framework for this recession recovery is not the usual post-contraction expansion, but rather, the set of...

I have been saying that the framework for this recession recovery is not the usual post-contraction expansion, but rather, the set of...

Wall Street is an industry that rewards a herd mentality; it certainly is not a fan of contrarian thinking. Indeed, any negativity,...

Wall Street is an industry that rewards a herd mentality; it certainly is not a fan of contrarian thinking. Indeed, any negativity,...

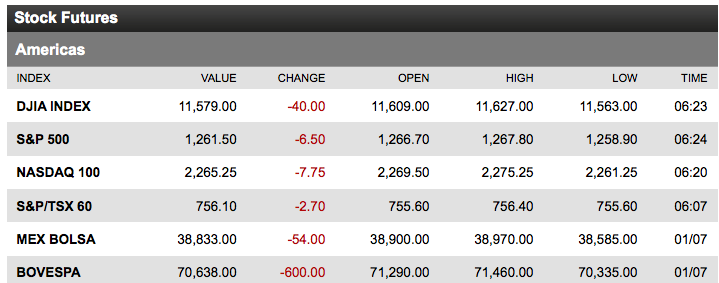

> European governments are preparing to borrow at least $43 billion this week, reflecting deterioration in the sovereign debt story....

> European governments are preparing to borrow at least $43 billion this week, reflecting deterioration in the sovereign debt story....

Get subscriber-only insights and news delivered by Barry every two weeks.