> Source: U.S. Portrait, in Numbers SAM ROBERTS NYT. January 7, 2011 http://www.nytimes.com/2011/01/08/us/08census.html

> Source: U.S. Portrait, in Numbers SAM ROBERTS NYT. January 7, 2011 http://www.nytimes.com/2011/01/08/us/08census.html

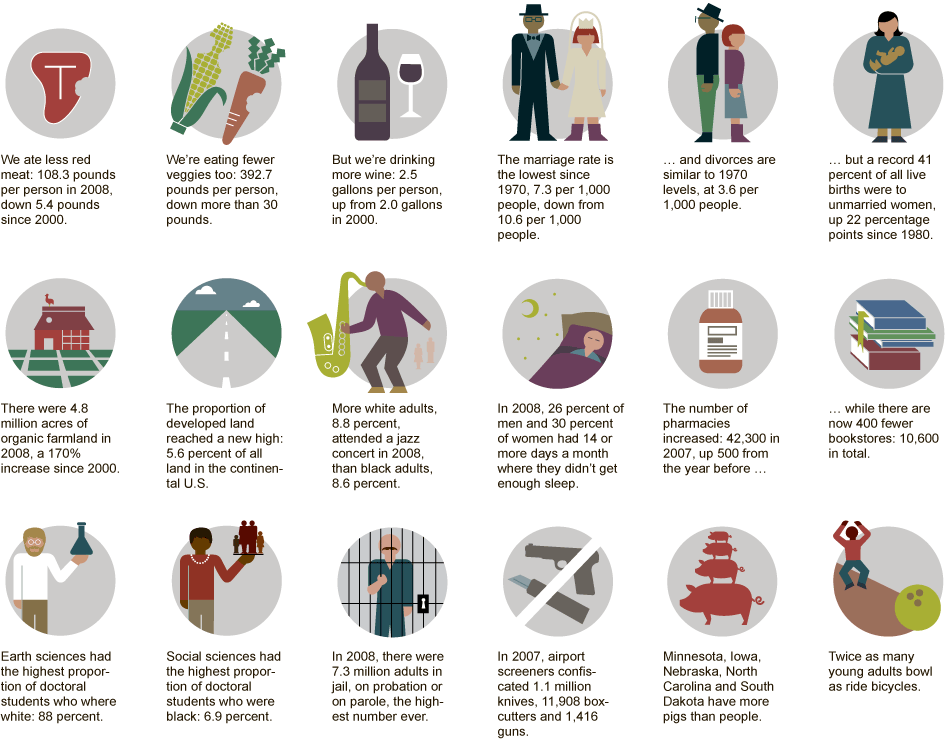

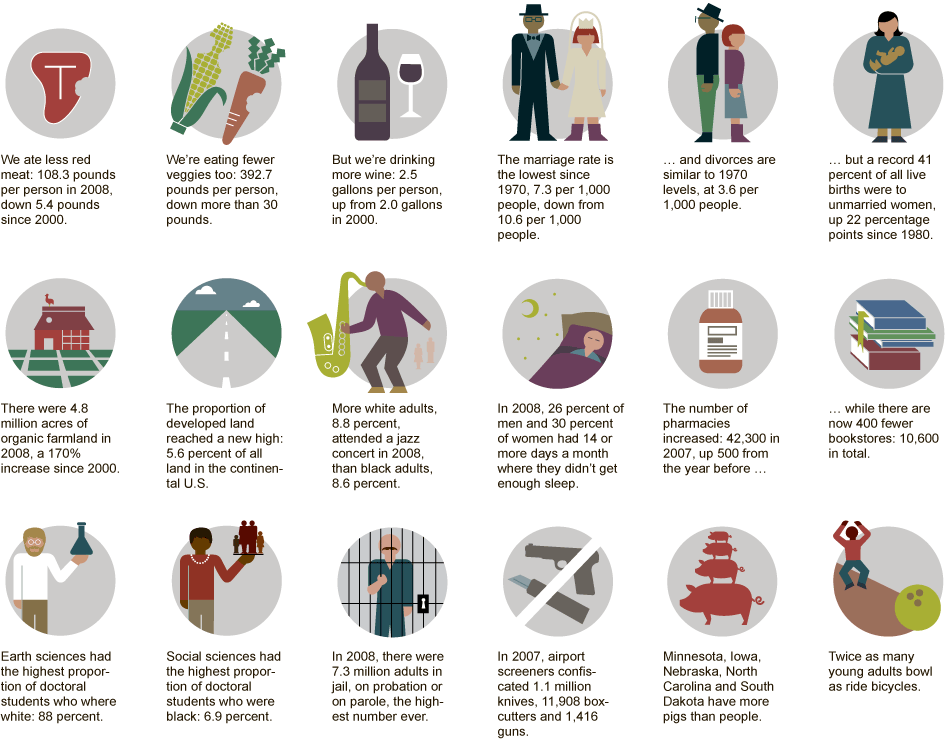

US by the Numbers

> Source: U.S. Portrait, in Numbers SAM ROBERTS NYT. January 7, 2011 http://www.nytimes.com/2011/01/08/us/08census.html

> Source: U.S. Portrait, in Numbers SAM ROBERTS NYT. January 7, 2011 http://www.nytimes.com/2011/01/08/us/08census.html