373-Hit Wonder: Girl Talk hits the NYT Magazine

I previously mentioned Girl Talk (See Girl Talk: AllDay and A Different Kind of Top 10 Music List for 2010), the massive mashup of boomer...

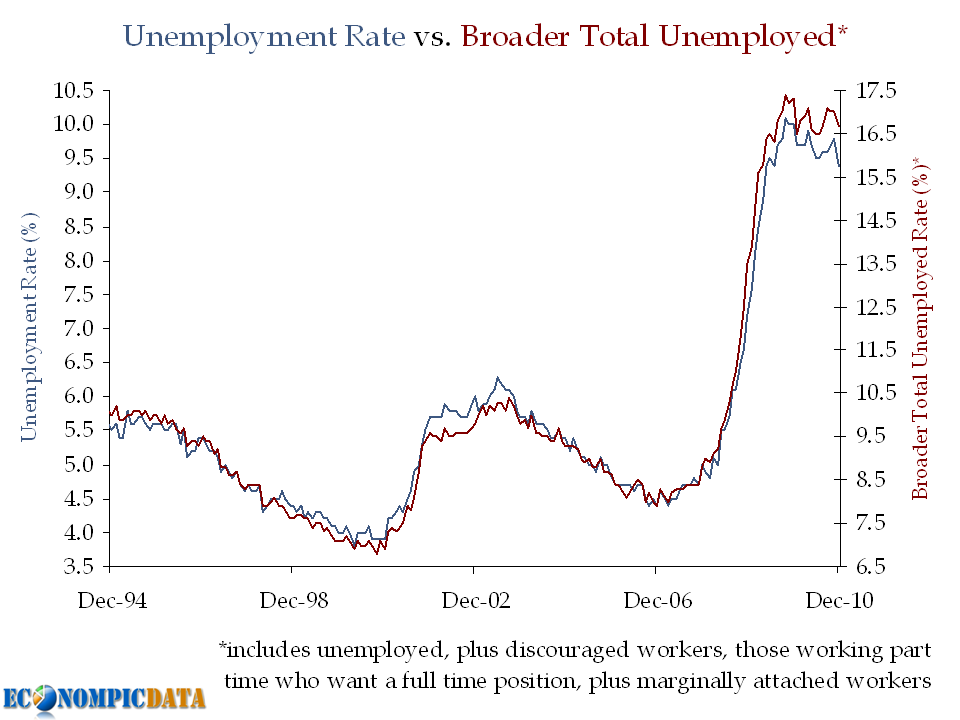

These are a few of my favorite charts generated by yesterday’s NFP data: > click for ginormous charts U6 vs U3 Unemployment...

These are a few of my favorite charts generated by yesterday’s NFP data: > click for ginormous charts U6 vs U3 Unemployment...

Chris Whalen is a pal of mine, and the author of Inflated: How Money and Debt Built the American Dream. The book is developing a cult...

Chris Whalen is a pal of mine, and the author of Inflated: How Money and Debt Built the American Dream. The book is developing a cult...

> > I spent the last hour of the week discussing NFP, Foreclosures with David Wilson and Pimm Fox. I prefer to be in the studio,...

> > I spent the last hour of the week discussing NFP, Foreclosures with David Wilson and Pimm Fox. I prefer to be in the studio,...

Get subscriber-only insights and news delivered by Barry every two weeks.