Kevin Ferry Chief Market Strategist Cronus Contrarian Corner www.cronusfutures.com ~~~ In 1993, after digging 22 kilometers of tunnel in...

Read More

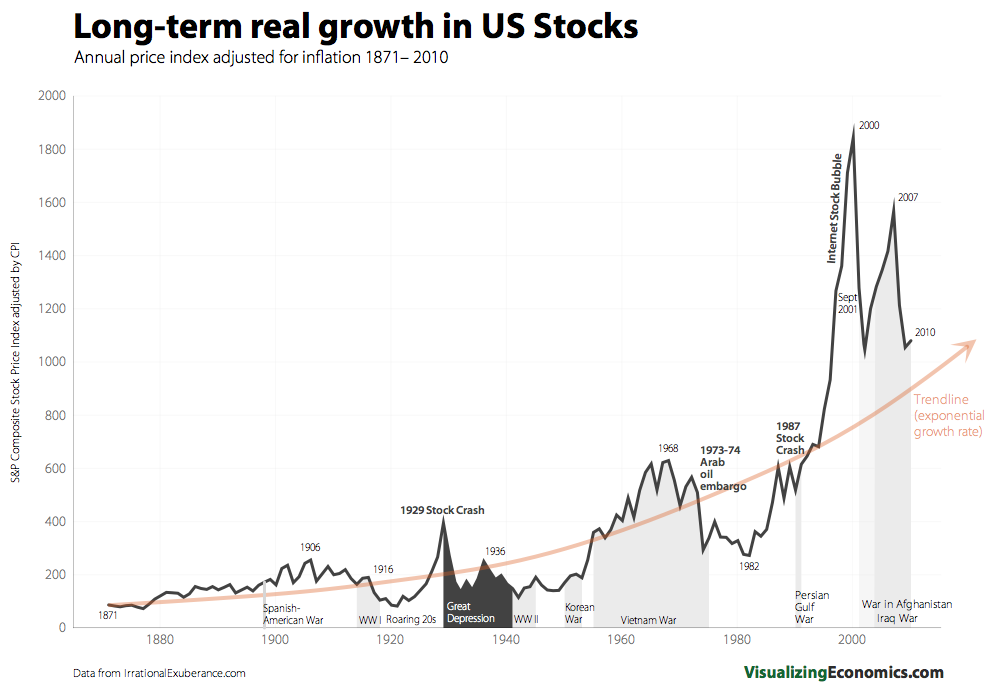

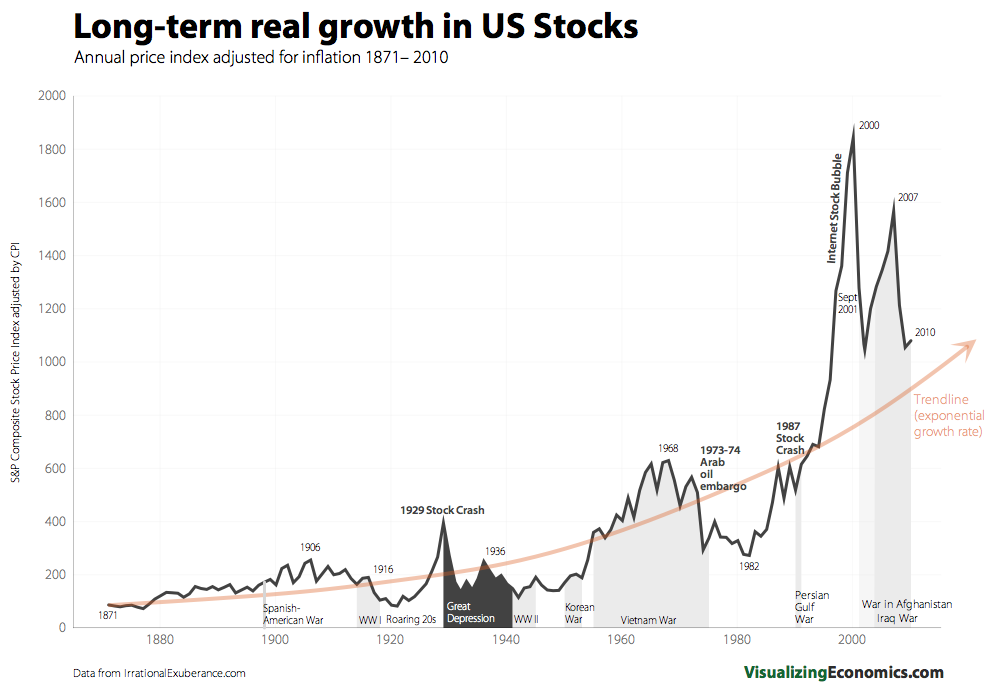

I was kicking around some of the outstanding charts at Visualizing Economics, when these two below leapt out at me. The first chart shows...

I was kicking around some of the outstanding charts at Visualizing Economics, when these two below leapt out at me. The first chart shows...

Read More

Attention Americans: THIS is how you deal with heavy snow. Notice the expensive equipment; the high paid staff. You want your streets...

Read More

~~~ Source: Why Facebook Is Such a Crucial Friend for Goldman PETER LATTMAN NYT, January 3, 2011...

Read More

I love this quote: “Next time you hear a banker denounce mark-to-market rules, ask if he runs his business that way. Will he offer...

Read More

Soft landing hopes in China after the moderating manufacturing indices over the weekend helped to send the Shanghai index higher by 1.6%...

Read More

Bruce Bartlett is an American historian and economist; he was a domestic policy adviser to President Ronald Reagan and was a Treasury...

Read More

Bank of America settled numerous claims with Fannie Mae for an astonishingly cheap rate, according to a Bloomberg report. A premium of...

Read More

From AAII.com: Individual investors kept their portfolio allocations to equities essentially unchanged last month, according to the...

Read More

I was kicking around some of the outstanding charts at Visualizing Economics, when these two below leapt out at me. The first chart shows...

I was kicking around some of the outstanding charts at Visualizing Economics, when these two below leapt out at me. The first chart shows...