Back in the Saddle

After a week of holiday festivities, its good to be back in the swing of things. I have a few exciting items in the hopper for the coming...

The Art of Argument

The Art of Argument from Bryan Villagonzalo on Vimeo. Dialogue scene from THANK YOU FOR SMOKING.

“New Years” Readings for Monday

Here are the latest additions to my Instapaper: • The New Speed of Money, Reshaping Markets (NYT) • Electric Cars Get Charged for...

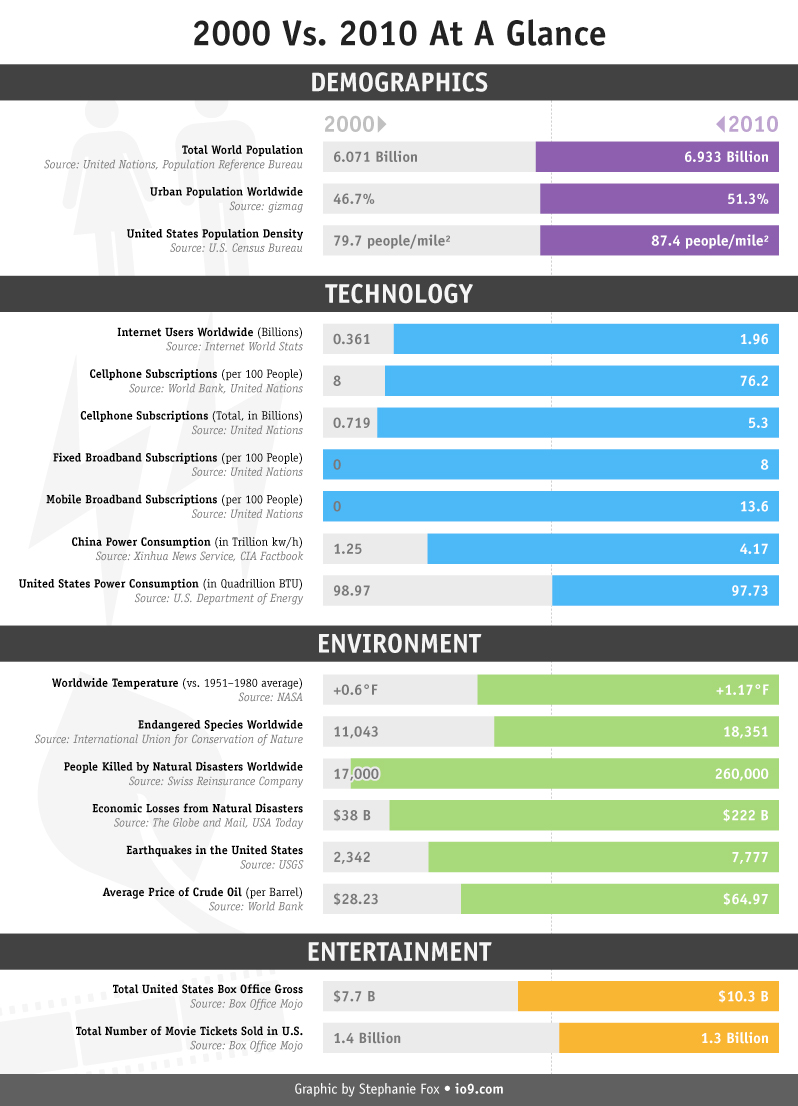

How the World Has Changed from 2000 to 2010

ISM good but in line

The ISM manufacturing index was right in line with expectations at 57, up a touch from 56.6 in Nov and the best since May. New Orders...

FDIC Bank Closings for 2010

Here is a look at bank closings for the year 2010 (note this does not include any closings the last 2 weeks of the year). All charts...

Here is a look at bank closings for the year 2010 (note this does not include any closings the last 2 weeks of the year). All charts...

Top 10 Mistakes in making Behavioral Changes

Its the beginning of the new year, and you probably made some resolutions. Odds are that by the time this month is halfway over, all...

Trends Don’t Last Forever . . . What is Peaking?

This reminds em of “Downsizing America” post from 2 years ago (February 2009): > > Source: Most Trends Don’t Last...