INVESTING IN A STRUCTURALLY UNBALANCED WORLD

Peter T Treadway, PhD Historical Analytics LLC www.thedismaloptimist.com pttreadway-at-hotmail.com 305 761 4718 852 9409 1186 December...

> In yesterday’s post Slowest States to Foreclose, I referenced material from LPS Mortgage Monitor. Several commenters and...

> In yesterday’s post Slowest States to Foreclose, I referenced material from LPS Mortgage Monitor. Several commenters and...

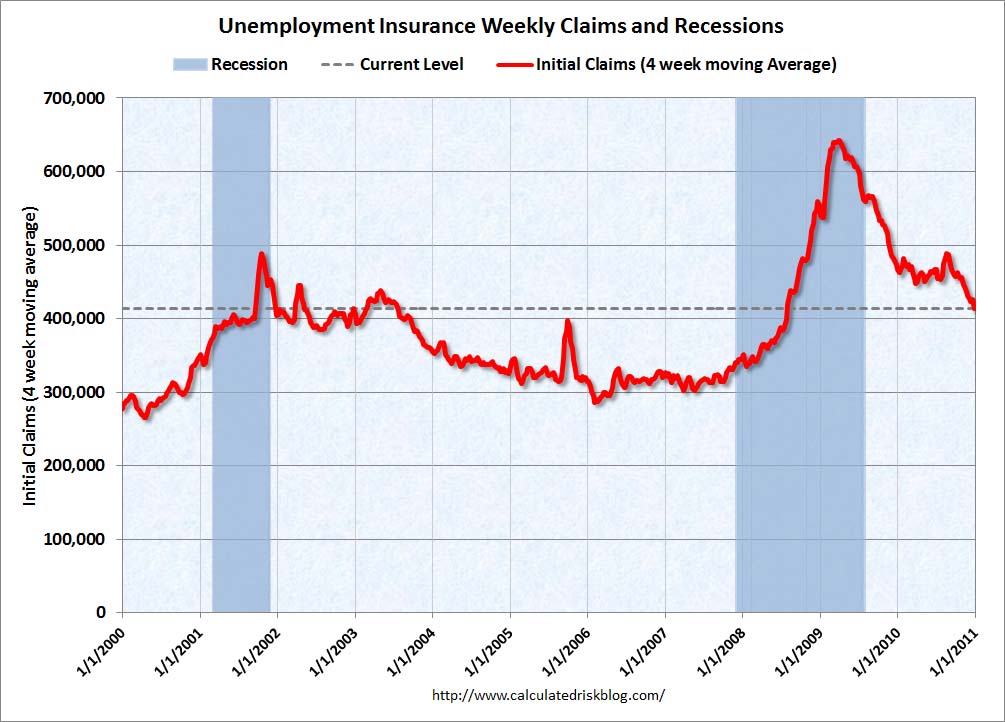

Claims for jobless benefits dropped to the lowest level in ore than two years, falling below the crucial 400k level. The four-week...

Claims for jobless benefits dropped to the lowest level in ore than two years, falling below the crucial 400k level. The four-week...

Get subscriber-only insights and news delivered by Barry every two weeks.