Fascinating 2 Hours with Keith Richards at home — its quite an interesting conversation with the Rolling Stone’s guitarist....

Fascinating 2 Hours with Keith Richards at home — its quite an interesting conversation with the Rolling Stone’s guitarist....

Read More

China’s private sector mfr’g PMI for Dec fell to a 3 month low but at 54.4 still reflects expansion vs 55.3 in Nov. With...

Read More

Foreclosure Mill attorney explains how he fabricates the evidence assigning mortgages to his clients: A few pages in the beginning of...

Read More

The full version of Hans Rosling’s Joy of Stats is now available in its entirety (below). Funny thing about the way memes circulate...

Read More

David R. Kotok, Rick Santelli vs. Congressman Mica December 29, 2010 > Rick Santelli is wrong. Yesterday, Larry Kudlow asked Rick...

Read More

According to Dictionary.com, the definition of a speculative bubble is “a temporary market condition created through excessive...

Read More

Even more holiday chart porn, via Daily Infographic: > click for ginormous infographic:

Even more holiday chart porn, via Daily Infographic: > click for ginormous infographic:

Read More

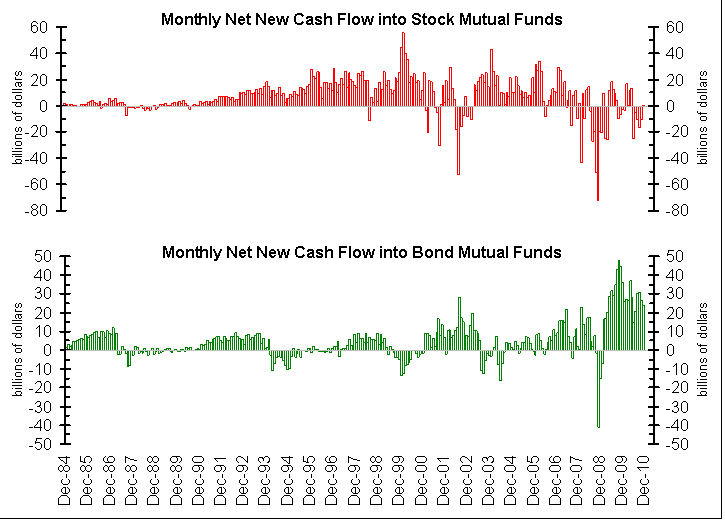

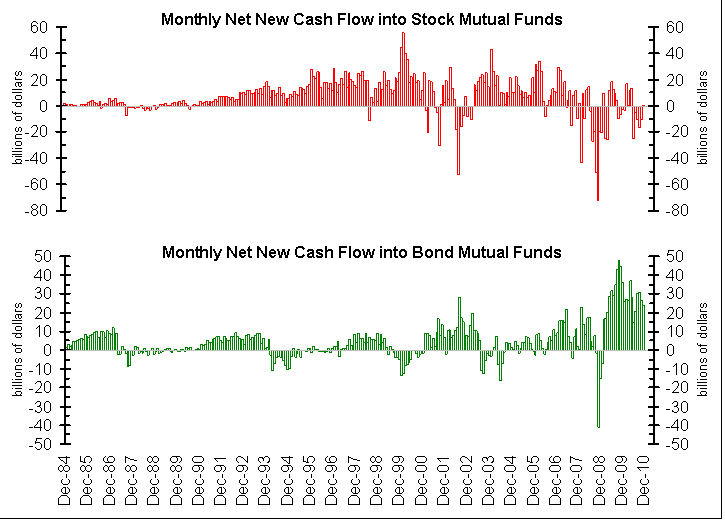

> The chart above, courtesy of Bianco Research, gives you a sense of how much enthusiasm there has been for Bonds, at the tail end of...

> The chart above, courtesy of Bianco Research, gives you a sense of how much enthusiasm there has been for Bonds, at the tail end of...

Read More

The excuses given for rampant, systemic, illegal foreclosure activity by banks is the overwhelming volume the local offices have to deal...

Read More

On the heels of the sharp US Treasury selloff yesterday and with London back open, yields in Europe are heading higher again. In...

Read More

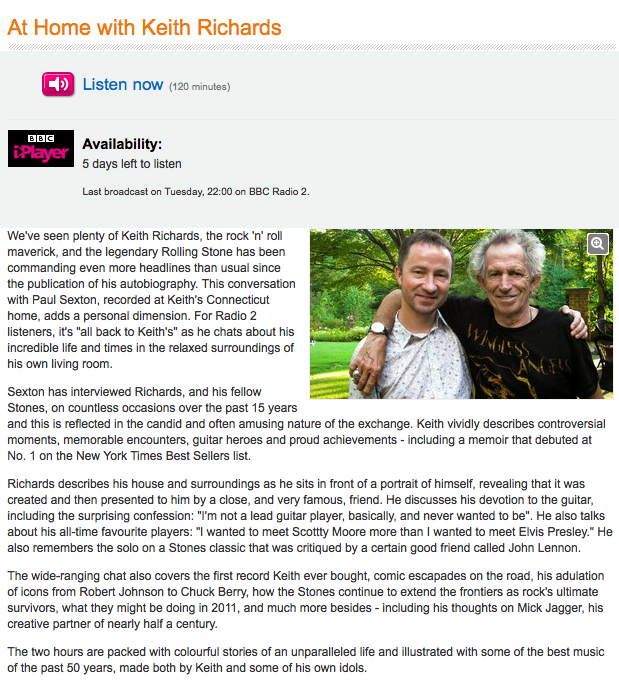

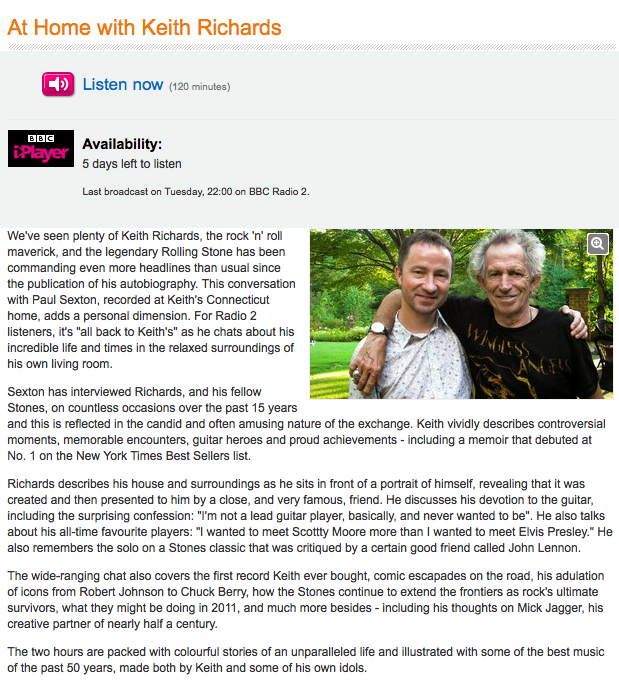

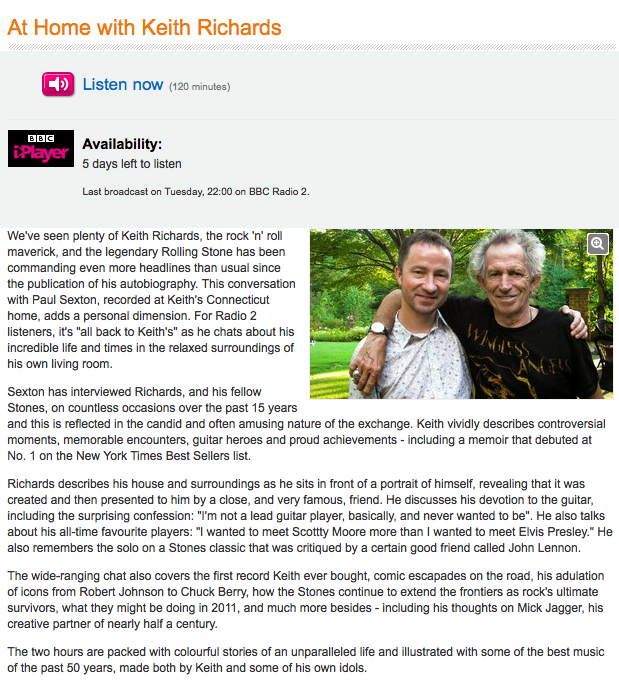

Fascinating 2 Hours with Keith Richards at home — its quite an interesting conversation with the Rolling Stone’s guitarist....

Fascinating 2 Hours with Keith Richards at home — its quite an interesting conversation with the Rolling Stone’s guitarist....

Fascinating 2 Hours with Keith Richards at home — its quite an interesting conversation with the Rolling Stone’s guitarist....

Fascinating 2 Hours with Keith Richards at home — its quite an interesting conversation with the Rolling Stone’s guitarist....