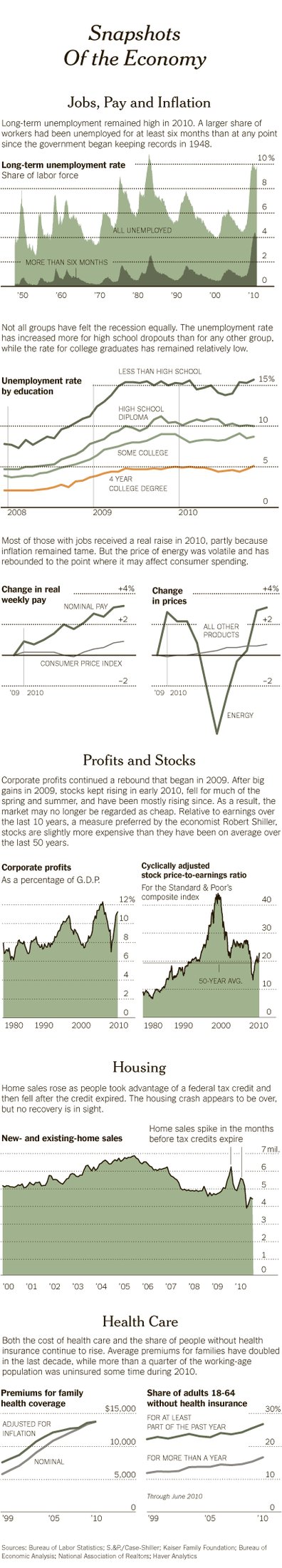

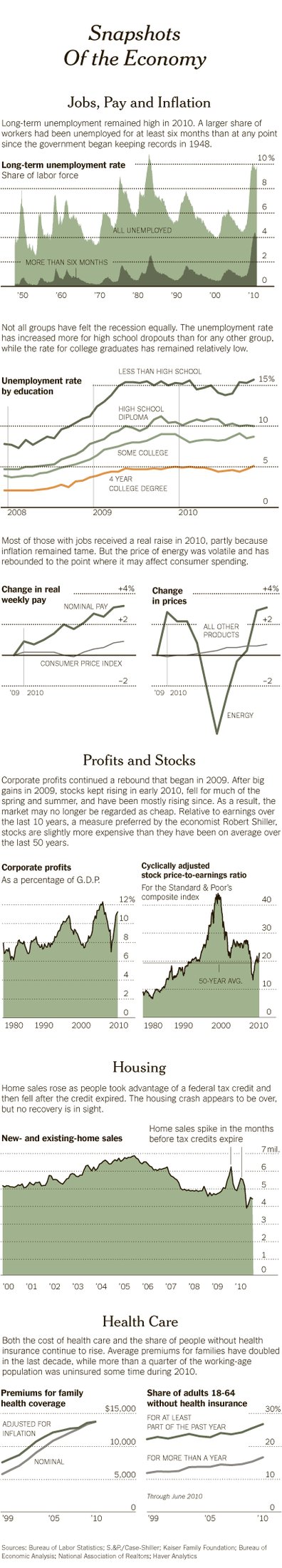

David Leonhardt has a short column in today’s NYT that is noteworthy for it excellent chart porn: > click for ginormous version:...

David Leonhardt has a short column in today’s NYT that is noteworthy for it excellent chart porn: > click for ginormous version:...

Read More

How to be ahead of 2011’s biggest investment fads, with Josh Brown, Fusion Analytics.

Read More

If you are doing some post X-mas shopping for yourself, the first 6 seasons of Entourage are on sale at Amazon for $10 per set. Season 7...

If you are doing some post X-mas shopping for yourself, the first 6 seasons of Entourage are on sale at Amazon for $10 per set. Season 7...

Read More

One of my favorite US media outlets is the Christian Science Monitor. They have four guiding principles which many other media players...

Read More

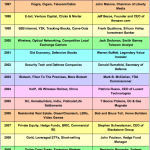

Another year in the books and I’ve updated my Investing Fads and Themes guide accordingly. It begins with 1996 because that was...

Another year in the books and I’ve updated my Investing Fads and Themes guide accordingly. It begins with 1996 because that was...

Read More

Dec Consumer Confidence at 52.5 was below estimates of 56.3 and down from 54.3 in Nov. Both the Present Situation and Future Expectation...

Read More

The Oct 20 city S&P/CS home price index fell 1% vs expectations of a fall of .6%. The y/o/y fall was .8% vs the forecast of a drop...

Read More

Doug Kass is a leading markets commentator, and writes daily for RealMoney Silver. > “Never make predictions, especially about...

Doug Kass is a leading markets commentator, and writes daily for RealMoney Silver. > “Never make predictions, especially about...

Read More

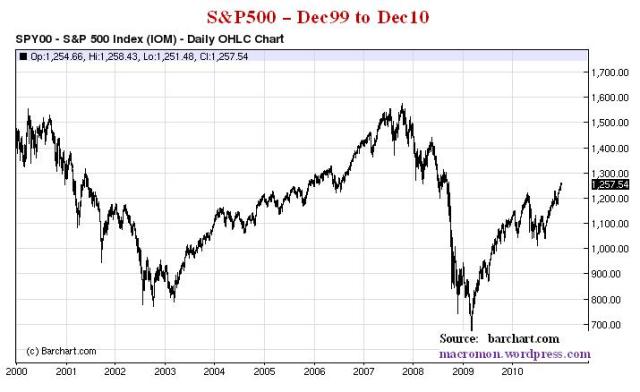

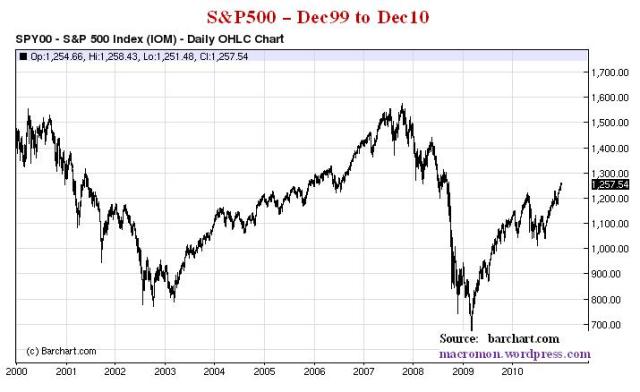

Global Macro Monitor produces informed opinion about markets and the global economy. This was originally published on December 27, 2010....

Global Macro Monitor produces informed opinion about markets and the global economy. This was originally published on December 27, 2010....

Read More

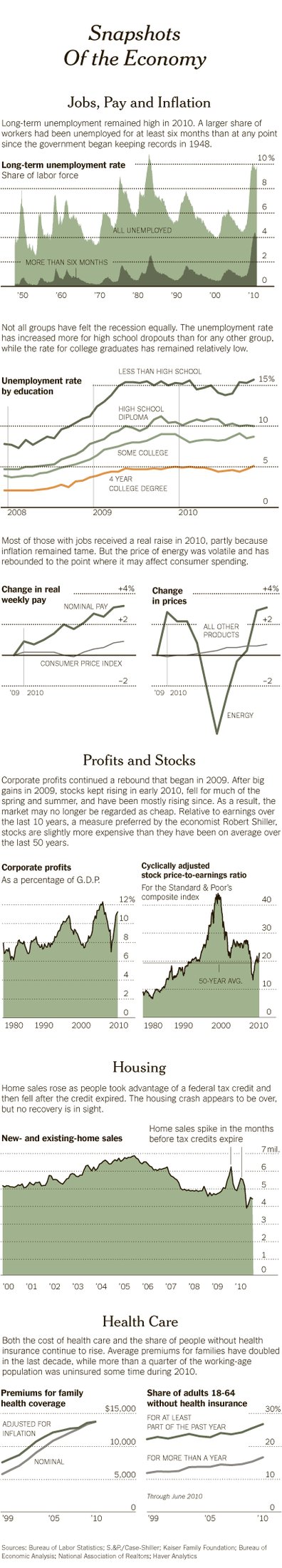

David Leonhardt has a short column in today’s NYT that is noteworthy for it excellent chart porn: > click for ginormous version:...

David Leonhardt has a short column in today’s NYT that is noteworthy for it excellent chart porn: > click for ginormous version:...

David Leonhardt has a short column in today’s NYT that is noteworthy for it excellent chart porn: > click for ginormous version:...

David Leonhardt has a short column in today’s NYT that is noteworthy for it excellent chart porn: > click for ginormous version:...