My thought on the yr end 2011 price target

It’s that time of the year when one of the more common Wall St sellside soothsayer concoctions hit the tape, that of 2011 year end...

As seen below EK shares had massive distribution (highlighted by red arrows and circle) This distribution was a cathartic puke if you...

As seen below EK shares had massive distribution (highlighted by red arrows and circle) This distribution was a cathartic puke if you...

Last week, in our Holiday Shopping for Audiophiles, I mentioned the Monster Turbine High-Performance In-Ear Speakers. I found they are...

Last week, in our Holiday Shopping for Audiophiles, I mentioned the Monster Turbine High-Performance In-Ear Speakers. I found they are...

This may be the last of the closures — (regulators prefer not to work on holiday weekends). We are still under 160, and with just 2...

This may be the last of the closures — (regulators prefer not to work on holiday weekends). We are still under 160, and with just 2...

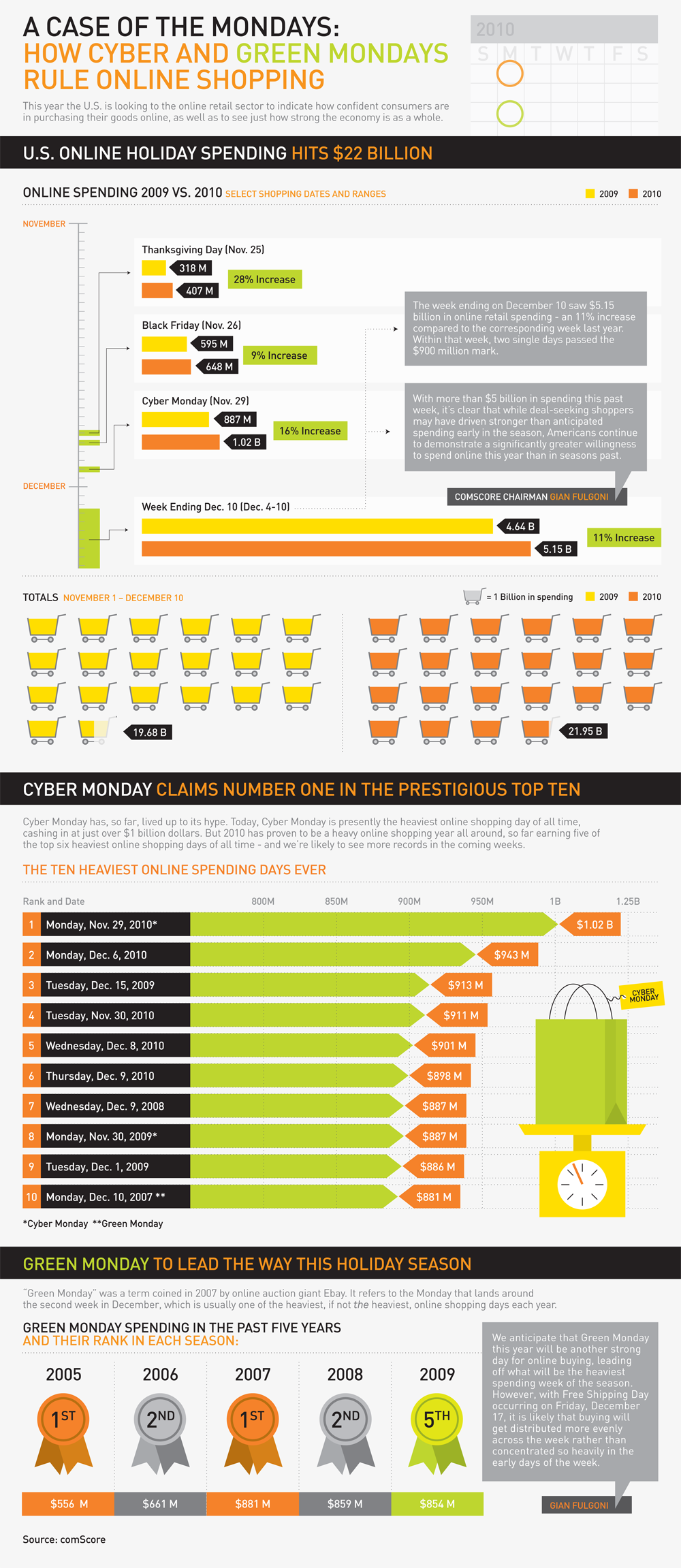

My buddy Jeff, who worked at Yahoo during the glory days of the late 1990s and early 2000s, then was President of Coupon.com, sends this...

My buddy Jeff, who worked at Yahoo during the glory days of the late 1990s and early 2000s, then was President of Coupon.com, sends this...

CNN/Money with an interesting deficit quiz . . . Warning: This is marred by their usual click whoring approach to saying in 30 pages what...

CNN/Money with an interesting deficit quiz . . . Warning: This is marred by their usual click whoring approach to saying in 30 pages what...

The feedback on our past two holiday lists (here and here) have been great, and some of the emails have been very heart warming tales of...

The feedback on our past two holiday lists (here and here) have been great, and some of the emails have been very heart warming tales of...

Get subscriber-only insights and news delivered by Barry every two weeks.