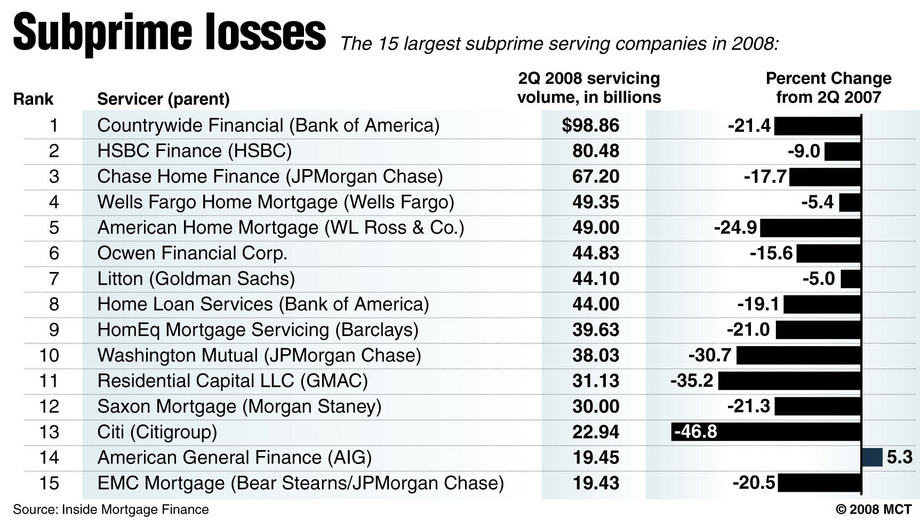

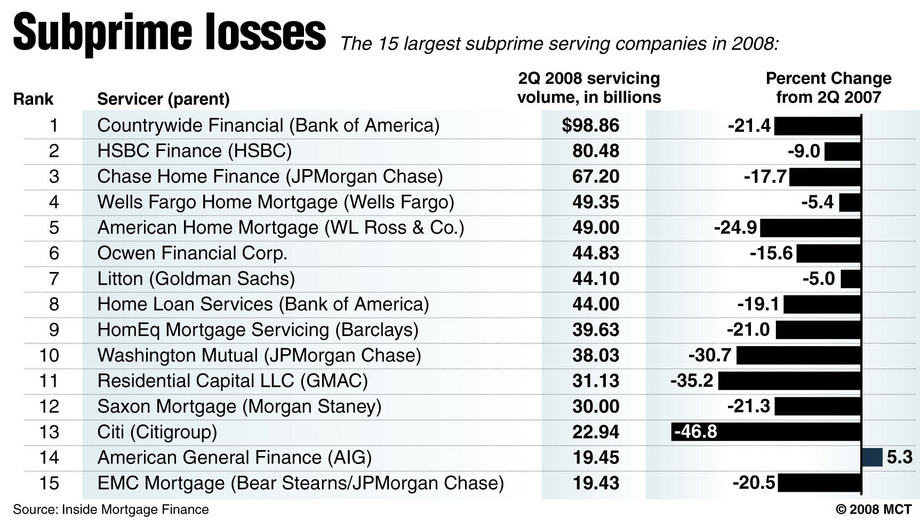

Here is a blast from October 2008 past: This chart as to who were the underwriters of the subprime loans. Federal Reserve Board data...

Here is a blast from October 2008 past: This chart as to who were the underwriters of the subprime loans. Federal Reserve Board data...

Private Sector Loans Triggered the Crisis

Here is a blast from October 2008 past: This chart as to who were the underwriters of the subprime loans. Federal Reserve Board data...

Here is a blast from October 2008 past: This chart as to who were the underwriters of the subprime loans. Federal Reserve Board data...