Income & Elections

I had the pleasure of collaborating with Catherine Rampell of the NY Times on a piece that she recently posted here. We looked at...

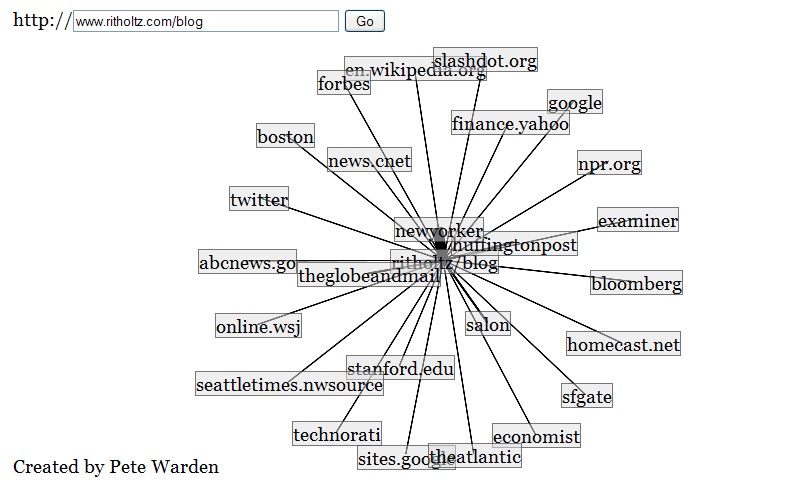

If you have ever wondered where search rankings come from, then you will find this to be a pretty cool tool: PageRankGraph: > >...

If you have ever wondered where search rankings come from, then you will find this to be a pretty cool tool: PageRankGraph: > >...

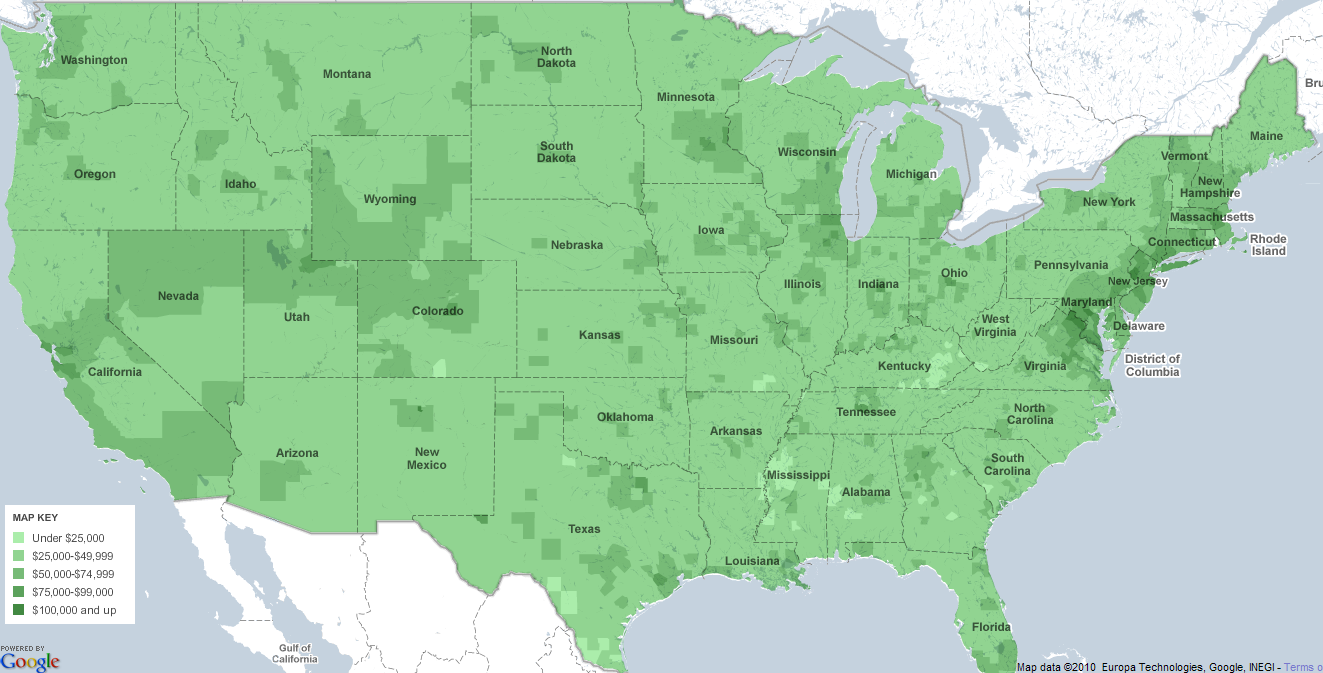

A pair of fascinating NYT/Census/Google map mash ups from the NYT this morning. Using US Census data, they look at a variety of data...

A pair of fascinating NYT/Census/Google map mash ups from the NYT this morning. Using US Census data, they look at a variety of data...

It appears that the web editors at the AEI have been busy. Peter Wallison, currently a member of the Financial Crisis Inquiry Commission,...

It appears that the web editors at the AEI have been busy. Peter Wallison, currently a member of the Financial Crisis Inquiry Commission,...

Get subscriber-only insights and news delivered by Barry every two weeks.