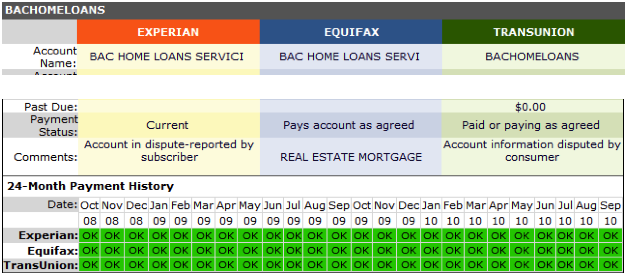

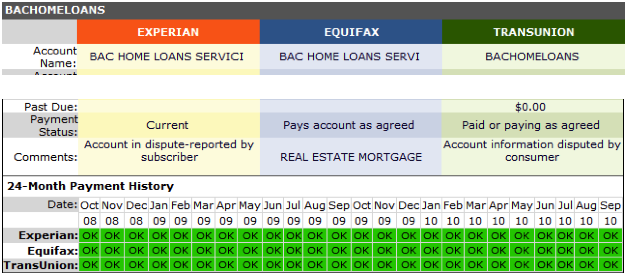

Let’s imagine the following scenario: You have a Jumbo mortgage with Bank of America. You are a good customer, do your banking with...

Let’s imagine the following scenario: You have a Jumbo mortgage with Bank of America. You are a good customer, do your banking with...

Where’s the Note? Leads BAC to Ding Credit Score

Let’s imagine the following scenario: You have a Jumbo mortgage with Bank of America. You are a good customer, do your banking with...

Let’s imagine the following scenario: You have a Jumbo mortgage with Bank of America. You are a good customer, do your banking with...