Positives: 1) Tax deal compromise in DC 2) Lower than expected Trade Deficit will lift Q4 GDP estimates 3) Initial Jobless Claims 4 week...

Read More

As evidenced by the front page of today’s WSJ, a big bull case for the economy and also for stocks is all the cash on company...

Read More

> I try to keep slow loading flash videos off the front page, and towards that end, I moved the Liquidity Smile post on Eastman Kodak...

Read More

Following yesterday’s appearance on Fast Money, I received lots of emails asking “What’s a Liquidity Smile?” Irt...

Read More

The 1st UoM confidence reading of the month was 74.2, 1.7 pts above expectations, up from 71.6 in Nov and is the best since June when it...

Read More

The 1st UoM confidence reading of the month was 74.2, 1.7 pts above expectations, up from 71.6 in Nov and is the best since June when it...

Read More

The PBOC again raised reserve requirements by 50 bps to 18.5% after Nov bank loans rose by 564b yuan, 64b above expectations and both...

Read More

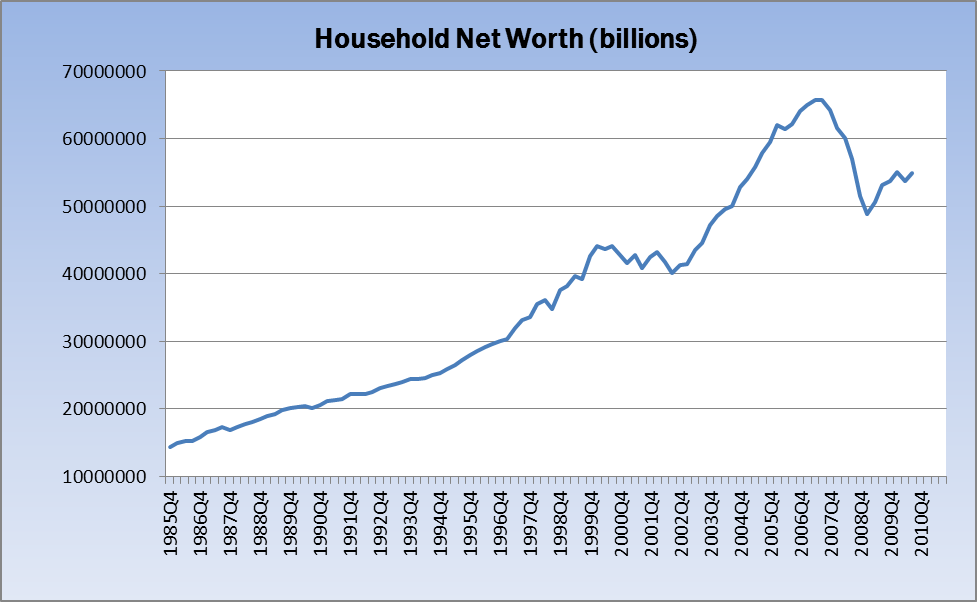

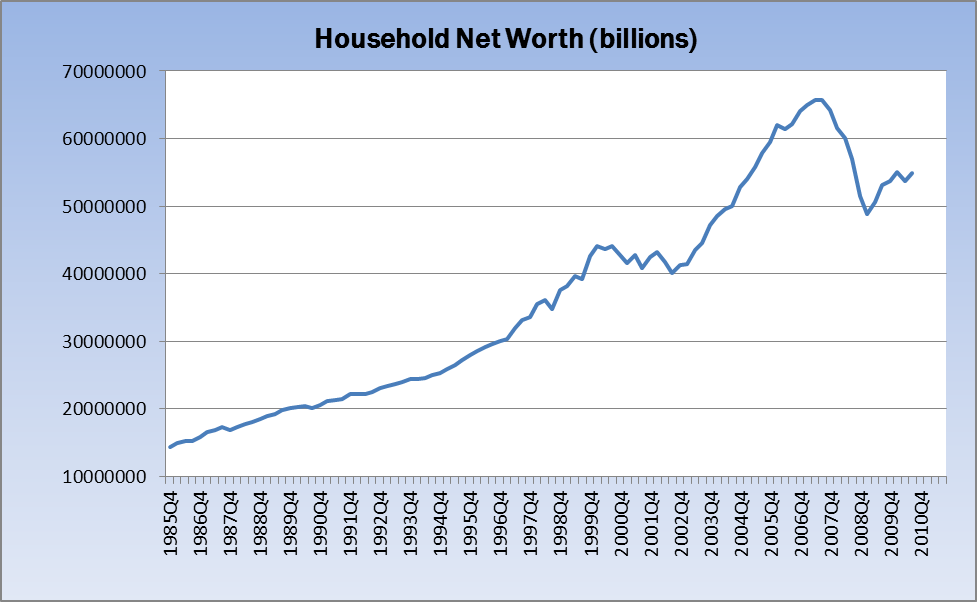

The Fed released its quarterly Flow of Funds (Z.1) report Thursday. Although the data is always somewhat stale (Q3 was released today),...

The Fed released its quarterly Flow of Funds (Z.1) report Thursday. Although the data is always somewhat stale (Q3 was released today),...

Read More

Lyrical Flowcharts: Make your own Lyrical Flowchart at http://lucidchart.com and tag us @lyricalflows. Those we like, we’ll make...

Read More

In today’s NYT comes this sign of speculative excess in China: Day Trading Still Alive, Outsourced to China: “By some...

Read More

The Fed released its quarterly Flow of Funds (Z.1) report Thursday. Although the data is always somewhat stale (Q3 was released today),...

The Fed released its quarterly Flow of Funds (Z.1) report Thursday. Although the data is always somewhat stale (Q3 was released today),...