Liquidity Smile

Following yesterday’s appearance on Fast Money, I received lots of emails asking “What’s a Liquidity Smile?” Irt...

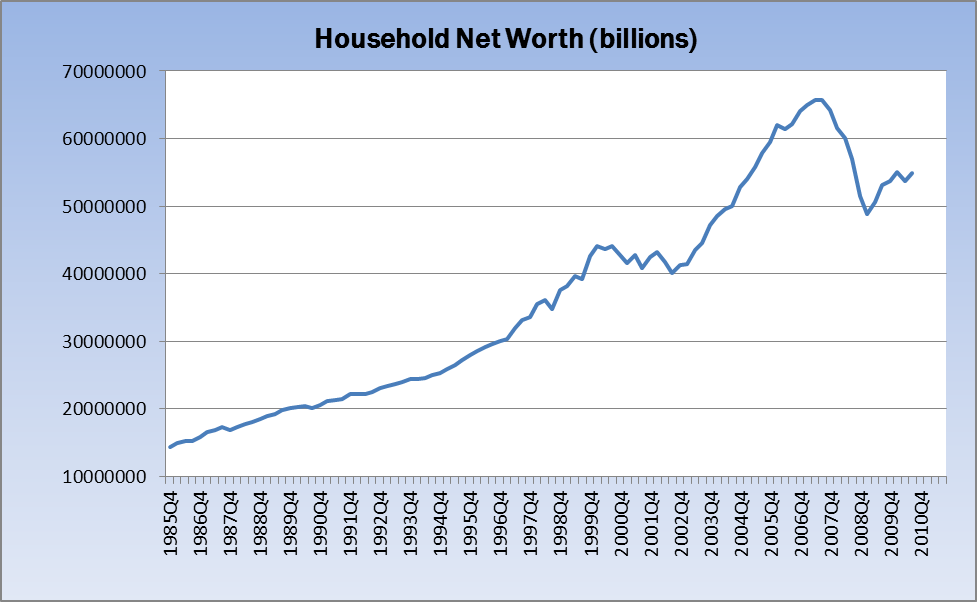

The Fed released its quarterly Flow of Funds (Z.1) report Thursday. Although the data is always somewhat stale (Q3 was released today),...

The Fed released its quarterly Flow of Funds (Z.1) report Thursday. Although the data is always somewhat stale (Q3 was released today),...

Get subscriber-only insights and news delivered by Barry every two weeks.