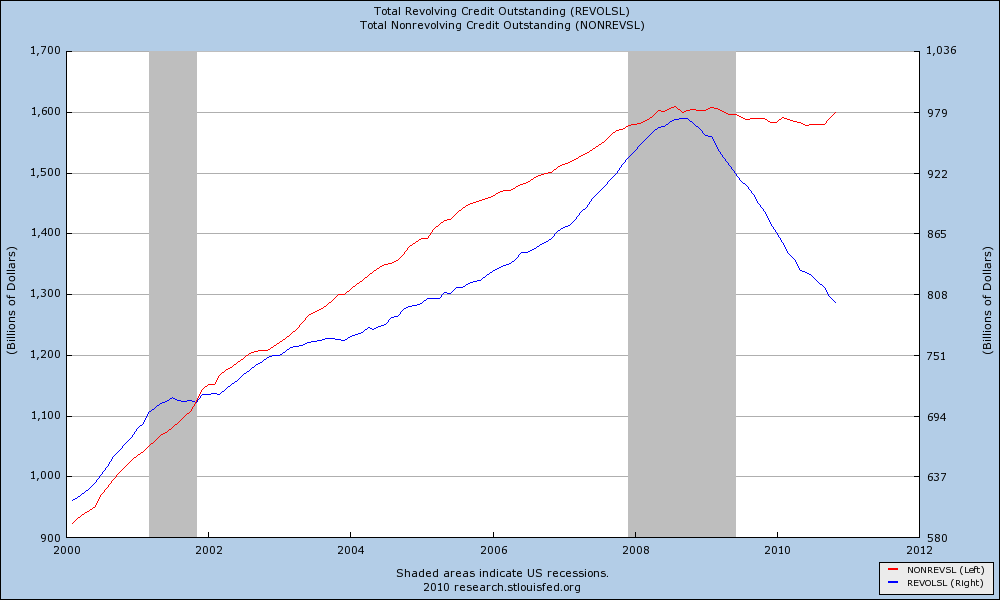

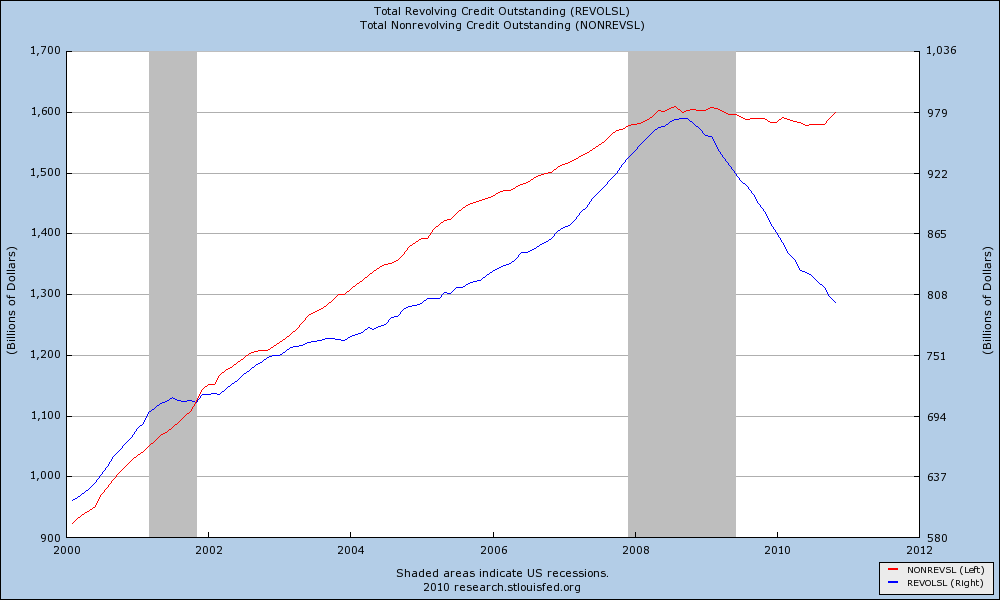

The Fed released its report on consumer credit, and it comes as no surprise that revolving credit eased for the 26th consecutive month as...

The Fed released its report on consumer credit, and it comes as no surprise that revolving credit eased for the 26th consecutive month as...

Consumer Deleveraging Continues

The Fed released its report on consumer credit, and it comes as no surprise that revolving credit eased for the 26th consecutive month as...

The Fed released its report on consumer credit, and it comes as no surprise that revolving credit eased for the 26th consecutive month as...