Yahoo Finance + StockTwits = Message Boards 2.0

Two firms I have more than a passing relationship — Yahoo Finance and StockTwits — have formally announced a deal to place...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His next book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His next book, Panderer for...

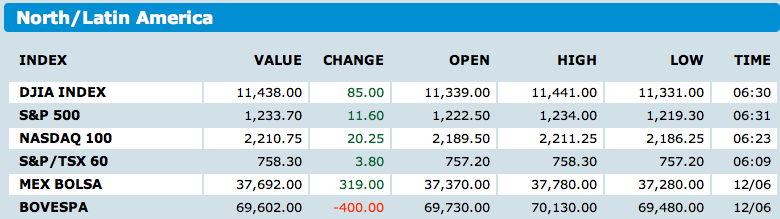

I was speaking to Pete, my head trader yesterday. I asked him if he thought traders would jump on any tax deal. His answer? Only if...

I was speaking to Pete, my head trader yesterday. I asked him if he thought traders would jump on any tax deal. His answer? Only if...

I remarked in a post on Friday that the November manufacturing PMIs came in much stronger than the market and I expected. Only Spain,...

I remarked in a post on Friday that the November manufacturing PMIs came in much stronger than the market and I expected. Only Spain,...

Okay, I’ll admit it: I am a bit of a shopper. I enjoy finding items, gadgets, books, etc. Not just high end items, but products...

Okay, I’ll admit it: I am a bit of a shopper. I enjoy finding items, gadgets, books, etc. Not just high end items, but products...

Get subscriber-only insights and news delivered by Barry every two weeks.