360° Interactive Snowboard Video

via White Lines, we found this cool video: Shot in 360°, you can change the view by click & dragging your mouse within the video....

Via Classic Driver, we see this wicked set of wheels, in a version called “Performante:” Lamborghini has announced a new,...

Via Classic Driver, we see this wicked set of wheels, in a version called “Performante:” Lamborghini has announced a new,...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

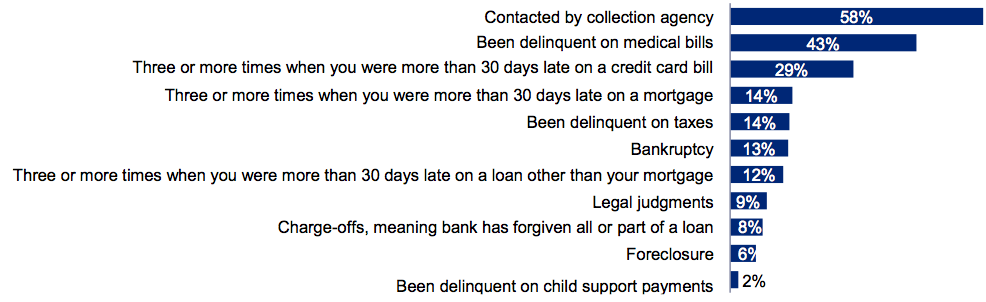

The new “first time defaulter” is the takeaway from a recent survey by Deloitte. The major points: • Individuals who...

The new “first time defaulter” is the takeaway from a recent survey by Deloitte. The major points: • Individuals who...

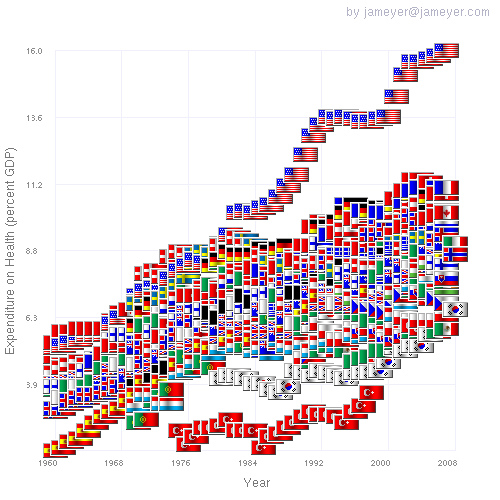

Fascinating set of charts from Jameyer’s Flickr stream: The US sprung ahead of other OECD nations in the 1980s. Costs were flat for...

Fascinating set of charts from Jameyer’s Flickr stream: The US sprung ahead of other OECD nations in the 1980s. Costs were flat for...

> The WSJ is reporting that the SEC is looking at specific Health Care takeovers that seemed to be tipped in advance to several big...

> The WSJ is reporting that the SEC is looking at specific Health Care takeovers that seemed to be tipped in advance to several big...

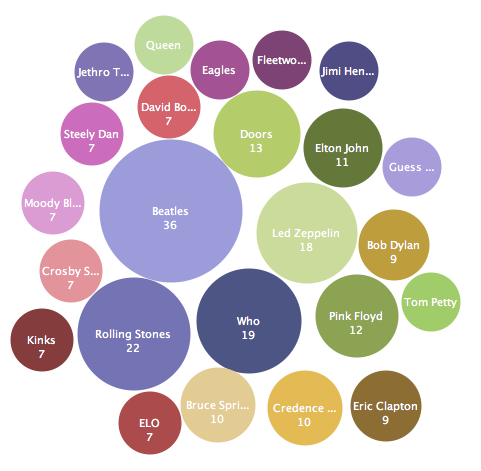

What? No Kanye ? via Many Eyes http://www-958.ibm.com/software/data/cognos/manyeyes/visualizations/number-of-songs-per-artist-in-the-

What? No Kanye ? via Many Eyes http://www-958.ibm.com/software/data/cognos/manyeyes/visualizations/number-of-songs-per-artist-in-the-

Get subscriber-only insights and news delivered by Barry every two weeks.