Fed Chairman Bernanke On 60 Minutes

The Economy Fed Chairman Bernanke On The Economy Fed Chairman Ben Bernanke discusses pressing economic issues, including unemployment,...

Via Classic Driver, we see this wicked set of wheels, in a version called “Performante:” Lamborghini has announced a new,...

Via Classic Driver, we see this wicked set of wheels, in a version called “Performante:” Lamborghini has announced a new,...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at...

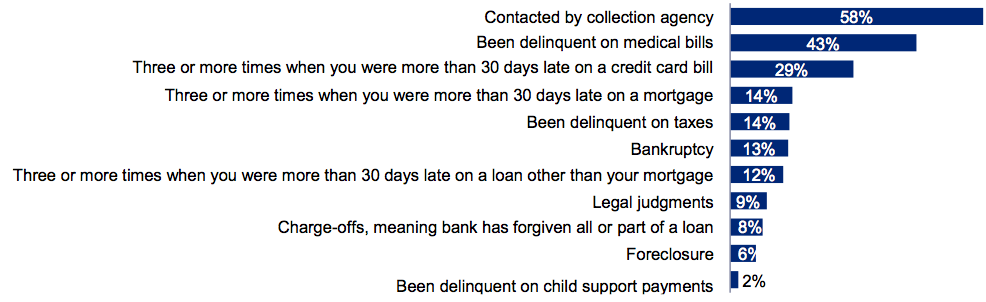

The new “first time defaulter” is the takeaway from a recent survey by Deloitte. The major points: • Individuals who...

The new “first time defaulter” is the takeaway from a recent survey by Deloitte. The major points: • Individuals who...

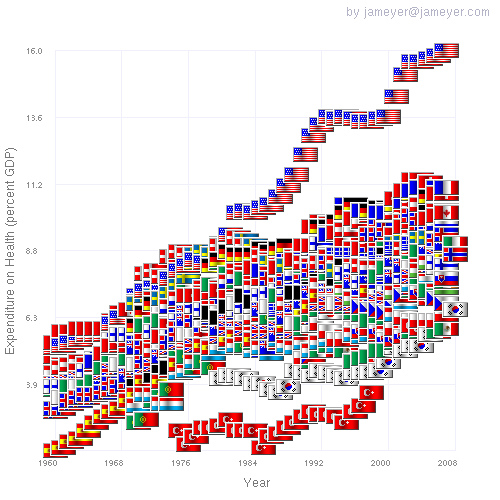

Fascinating set of charts from Jameyer’s Flickr stream: The US sprung ahead of other OECD nations in the 1980s. Costs were flat for...

Fascinating set of charts from Jameyer’s Flickr stream: The US sprung ahead of other OECD nations in the 1980s. Costs were flat for...

> The WSJ is reporting that the SEC is looking at specific Health Care takeovers that seemed to be tipped in advance to several big...

> The WSJ is reporting that the SEC is looking at specific Health Care takeovers that seemed to be tipped in advance to several big...

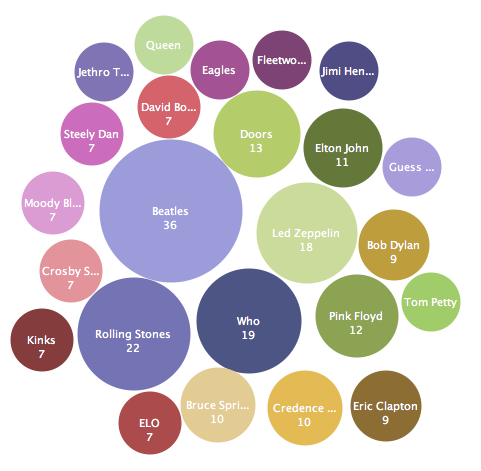

What? No Kanye ? via Many Eyes http://www-958.ibm.com/software/data/cognos/manyeyes/visualizations/number-of-songs-per-artist-in-the-

What? No Kanye ? via Many Eyes http://www-958.ibm.com/software/data/cognos/manyeyes/visualizations/number-of-songs-per-artist-in-the-

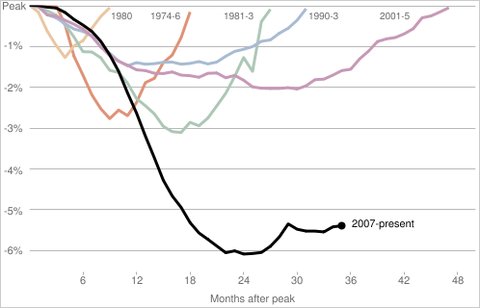

These are some of the more interesting charts that I’ve seen since Friday’s NFP (if you have any suggestions, make them here...

These are some of the more interesting charts that I’ve seen since Friday’s NFP (if you have any suggestions, make them here...

Did the US suffer from a giant Housing bubble? Not exactly. In his column this morning, Floyd Norris points to a data point that confirms...

Did the US suffer from a giant Housing bubble? Not exactly. In his column this morning, Floyd Norris points to a data point that confirms...

Get subscriber-only insights and news delivered by Barry every two weeks.