Virtuous Cycle: Will NFP Lead to More Capex, Hiring?

The employment situation has been gradually improving. Has it reached the point where an upside surprise is possible? Like Housing,...

I thought I had posted this before, but I cannot seem to find it . . . I guess I was thinking about the previously posted The World...

I thought I had posted this before, but I cannot seem to find it . . . I guess I was thinking about the previously posted The World...

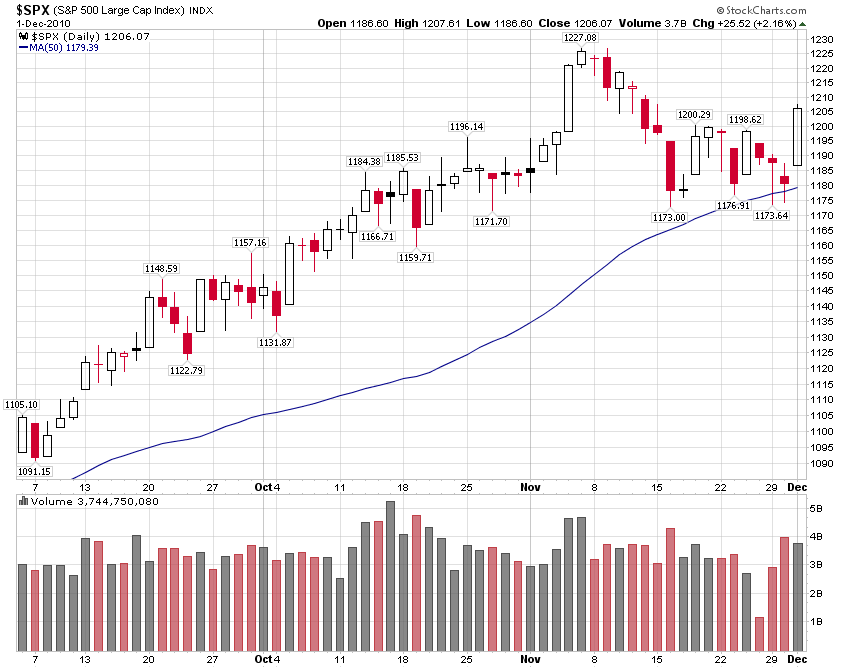

stockcharts.com > You’ve guys have heard my blather enough. Rather than discuss my viewpoints, I will open the floor: What say...

stockcharts.com > You’ve guys have heard my blather enough. Rather than discuss my viewpoints, I will open the floor: What say...

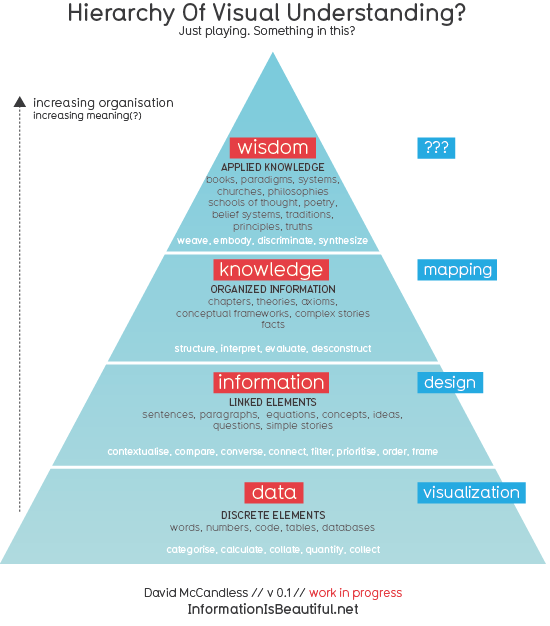

We have been having a series of interesting discussions lately on various aspects of the economy and markets. I notice that some traders...

We have been having a series of interesting discussions lately on various aspects of the economy and markets. I notice that some traders...

Get subscriber-only insights and news delivered by Barry every two weeks.