Paging Gordo, Part I

“The most valuable commodity I know of is information, wouldn’t you agree?” — Gordon Gekko, to Bud Fox, in Wall...

“The most valuable commodity I know of is information, wouldn’t you agree?” — Gordon Gekko, to Bud Fox, in Wall...

ADP says more private sector adds than expected

ADP said private sector job gains in Nov were 93k, 23k above expectations and Oct was revised higher by 39k to 82k. Averaging the two...

China to the rescue! At least for today

China to the rescue! At least for today. Both the Chinese state and private sector weighted PMI manufacturing indices rose to 7 month...

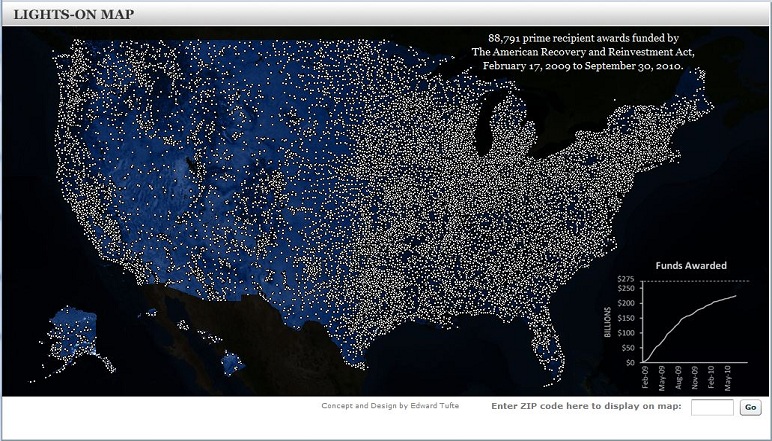

Distribution of Recovery Awards Map

Recovery.gov has a pretty cool flash animation, designed by Edward Tufte, the father of information design, and the author of Visual...

Recovery.gov has a pretty cool flash animation, designed by Edward Tufte, the father of information design, and the author of Visual...

Hi Ho. Hi Ho. To the center we will go

Vincent Farrell Soleil Securities Corporation November 30, 2010 ~~~ Bill Clinton could sniff the political winds better than most...

Holiday Year End Melt Up ?

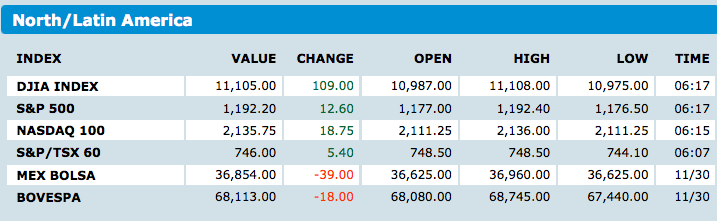

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...

The Story of Electronics

The Story of Electronics, releasing Tuesday, NOVEMBER 9, employs the Story of Stuff style to explore the high-tech revolution’s...