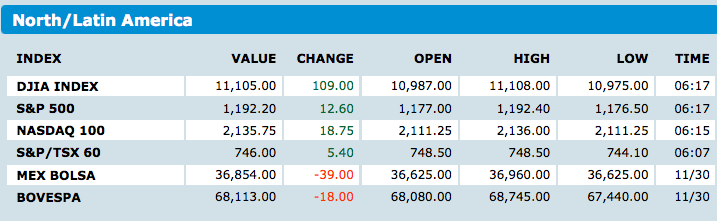

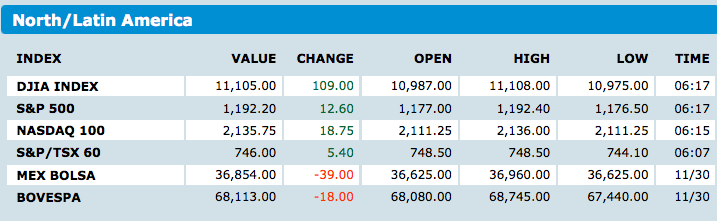

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...

Read More

The Story of Electronics, releasing Tuesday, NOVEMBER 9, employs the Story of Stuff style to explore the high-tech revolution’s...

Read More

> I did a quick hit for Fast Money tonight. You can see it here >

> I did a quick hit for Fast Money tonight. You can see it here >

Read More

click for video on Monday, November 29, 2010

click for video on Monday, November 29, 2010

Read More

I have no idea if this is true — the speculation that it is BofA comes via Raw Story — but the most likely banks are the big...

Read More

This just in: Econometric models bear little relation to reality ! (Also, JFK was shot) > click for larger infographic > Source:...

This just in: Econometric models bear little relation to reality ! (Also, JFK was shot) > click for larger infographic > Source:...

Read More

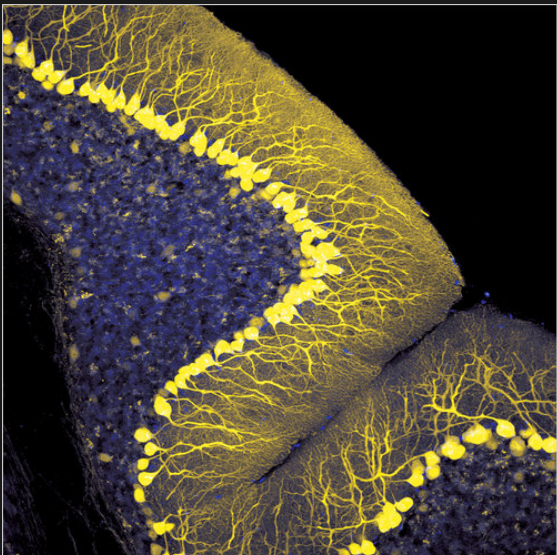

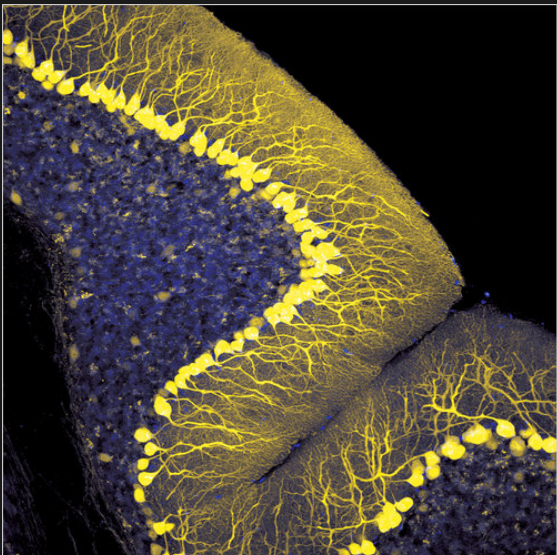

From the NYT, these electron microscopy photos are strangely beautiful: The last few decades have produced an explosion of new techniques...

From the NYT, these electron microscopy photos are strangely beautiful: The last few decades have produced an explosion of new techniques...

Read More

Nov Consumer Confidence was slightly better than expected at 54.1 vs the forecast of 53 and is up from 49.9 in Oct. It’s the best...

Read More

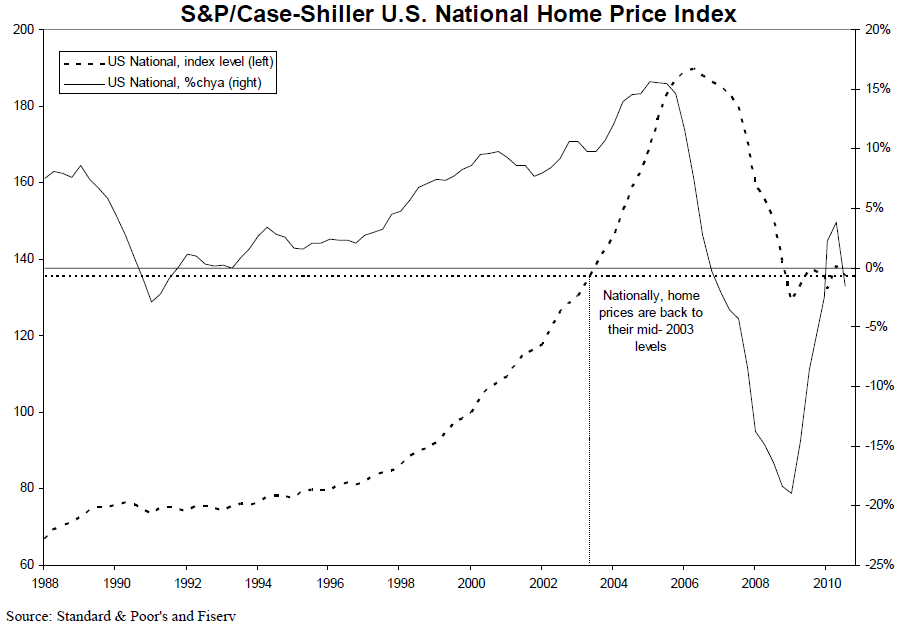

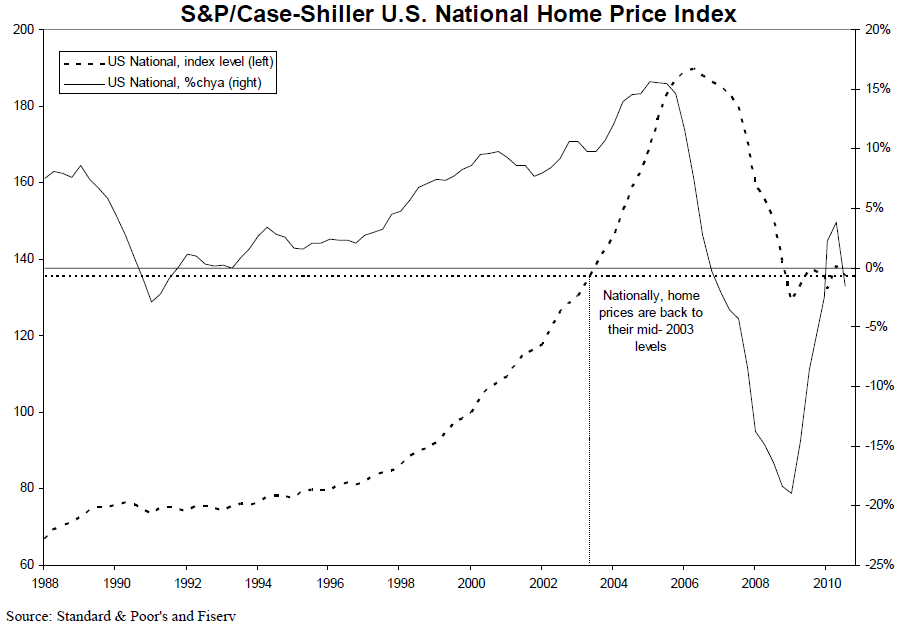

Oooh, this failed to launch (now I am having differently trouble, apparently, getting it posts up) Case-Shiller1 Home Price Indices...

Oooh, this failed to launch (now I am having differently trouble, apparently, getting it posts up) Case-Shiller1 Home Price Indices...

Read More

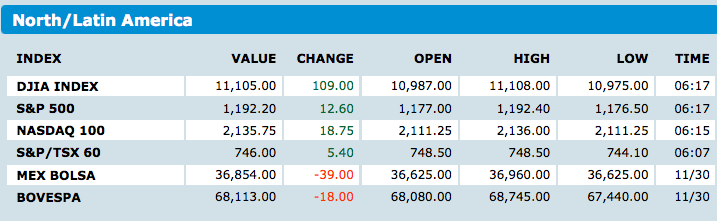

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...

click for updated futures > Its a new month, and it appears that cash getting put to work. Futures screaming higher, up more than a...