We Can Fix America If We Focus on What ALL Americans –...

While there are some things that liberals and conservatives will never agree about, there are many things that we already all agree on....

Recessions are on the Margin November 26, 2010 By John Mauldin > Recessions Are on the Margin A Rose is Still a Rose If It Feels Like...

Recessions are on the Margin November 26, 2010 By John Mauldin > Recessions Are on the Margin A Rose is Still a Rose If It Feels Like...

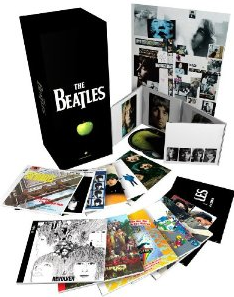

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....

Get subscriber-only insights and news delivered by Barry every two weeks.