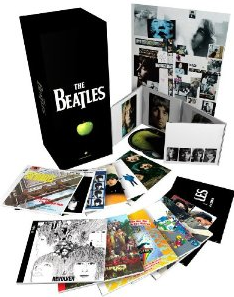

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....

Read More

I mentioned earlier that the I am avoiding the maddening crush of the crowds today, but I keep finding attractive deals online. I have...

I mentioned earlier that the I am avoiding the maddening crush of the crowds today, but I keep finding attractive deals online. I have...

Read More

Quote of the Day: “If I get even a whiff of an investigation, I want to get out before the next guy, especially if I know they have...

Read More

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His next book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His next book, Panderer for...

Read More

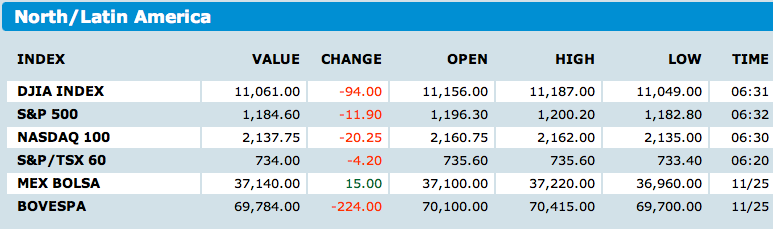

I first recommended GLD on Power lunch back in 2005. The Gold ETF was under $50, and the rec was greeted with widespread skepticism. The...

I first recommended GLD on Power lunch back in 2005. The Gold ETF was under $50, and the rec was greeted with widespread skepticism. The...

Read More

by Bob Lefsetz Ringo’s a revelation! Somehow, the Beatles coming to iTunes has become a business story, but that band was always...

Read More

The FT Deutschland is reporting that the EU is pressuring Portugal to be the next to walk the plank and quickly accept a bailout package...

Read More

Today’s info porn comes to us from der Spiegel: >

Today’s info porn comes to us from der Spiegel: >

Read More

With Thanksgiving behind us, we move into the period of mass consumption of useless baubles and silly/unwanted gifts. CNBC interviewed...

With Thanksgiving behind us, we move into the period of mass consumption of useless baubles and silly/unwanted gifts. CNBC interviewed...

Read More

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....

With Apple finally landing the Beatles for the iTunes Music store, I wondered if the competition was going to do anything in response....