Household Food Security in the US

Eighty-five percent of American households were food secure throughout the entire year in 2009, meaning that they had access at all...

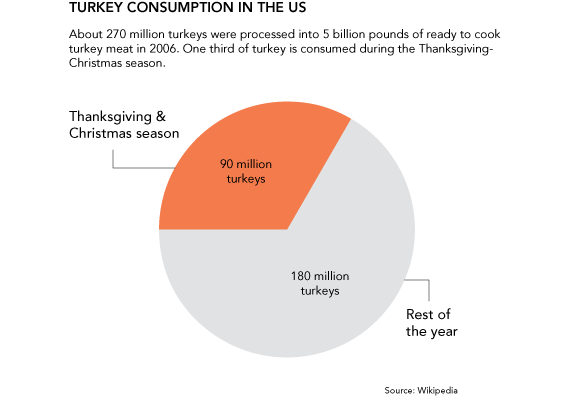

In the US, we eat almost 300 million turkeys per year. About a third of them are consumed in the month between Thanksgiving and...

In the US, we eat almost 300 million turkeys per year. About a third of them are consumed in the month between Thanksgiving and...

I yesterday summarized my market view in a post entitled “Commodity prices – on a knife’s edge”. For some additional perspective,...

I yesterday summarized my market view in a post entitled “Commodity prices – on a knife’s edge”. For some additional perspective,...

Black Friday Sales have already begun. I am not planning on going crazy, but since a planned trip to Florida during Xmas week had to be...

Black Friday Sales have already begun. I am not planning on going crazy, but since a planned trip to Florida during Xmas week had to be...

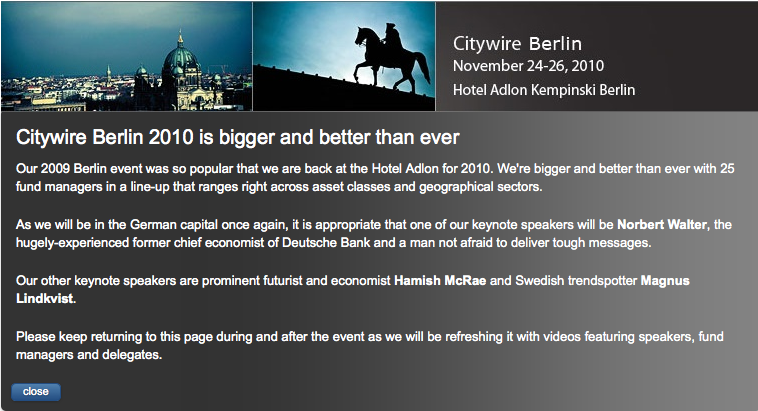

Each year, Citywire produces a terrific conference in Berlin. (I spoke there last year). This year, it is (unfortunately for us Yanks) on...

Each year, Citywire produces a terrific conference in Berlin. (I spoke there last year). This year, it is (unfortunately for us Yanks) on...

Get subscriber-only insights and news delivered by Barry every two weeks.