Stand By Me

Exquisite sound engineering mixing a series of street buskers from around the world — recorded, overlayed & mixed with one...

My favorite chart, via Bill at Calculated Risk: > Chart courtesy of Calculated Risk > See also Existing Home Inventory increases...

My favorite chart, via Bill at Calculated Risk: > Chart courtesy of Calculated Risk > See also Existing Home Inventory increases...

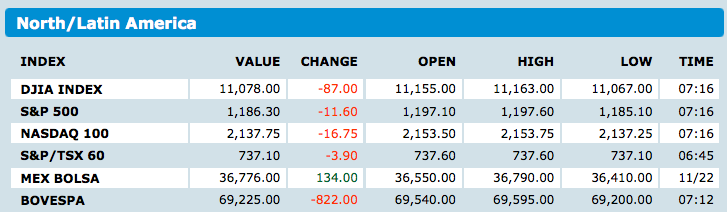

“Dude, you really love a good bloodbath, don’t you? You actually have fum when the market is getting killed.“ Prior to...

“Dude, you really love a good bloodbath, don’t you? You actually have fum when the market is getting killed.“ Prior to...

by Prieur du Plessis, writer of the Investment Postcards from Cape Town ~~~ The prices of industrial metals find themselves at crucial...

by Prieur du Plessis, writer of the Investment Postcards from Cape Town ~~~ The prices of industrial metals find themselves at crucial...

Yesterday, stocks climbed back from under pressure, closing nearly flat after an earlier shellacking, ostensibly due to the FBI raids of...

Yesterday, stocks climbed back from under pressure, closing nearly flat after an earlier shellacking, ostensibly due to the FBI raids of...

Get subscriber-only insights and news delivered by Barry every two weeks.