by James Bianco Bianco Research November 18, 2010 > The Wall Street Journal – Burton G. Malkiel: ‘Buy and Hold’ Is Still a...

by James Bianco Bianco Research November 18, 2010 > The Wall Street Journal – Burton G. Malkiel: ‘Buy and Hold’ Is Still a...

Read More

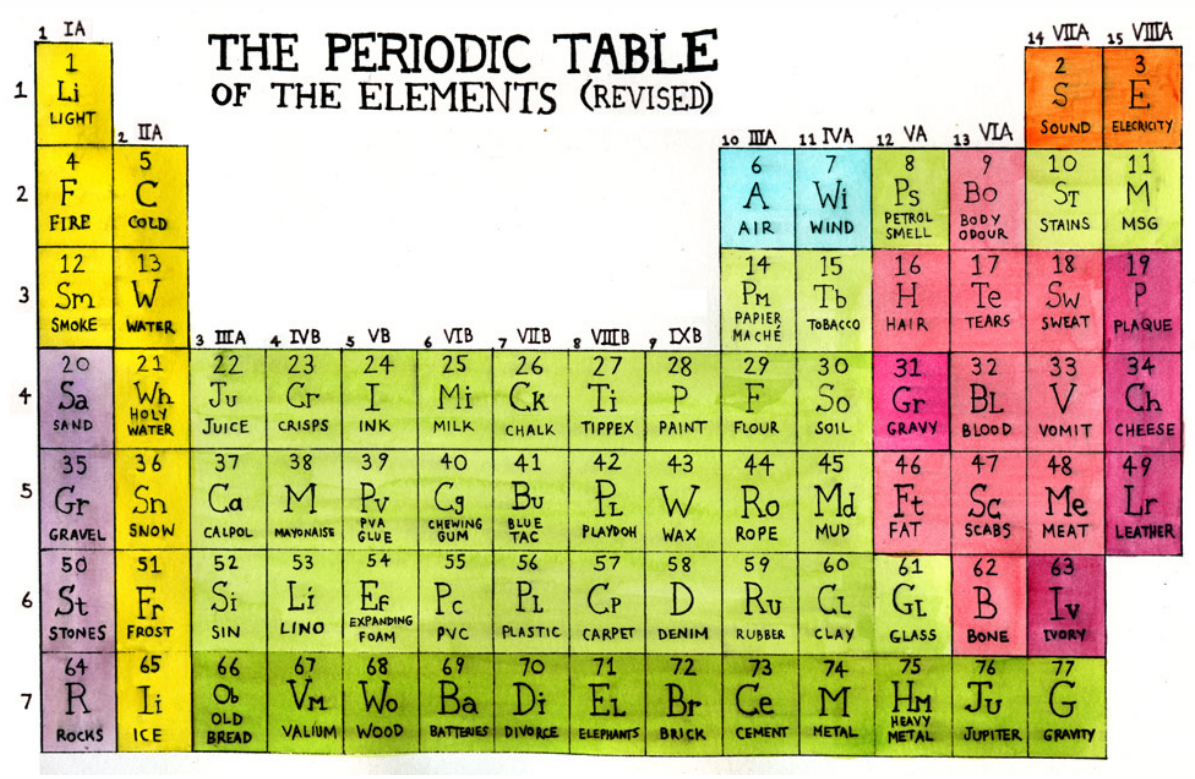

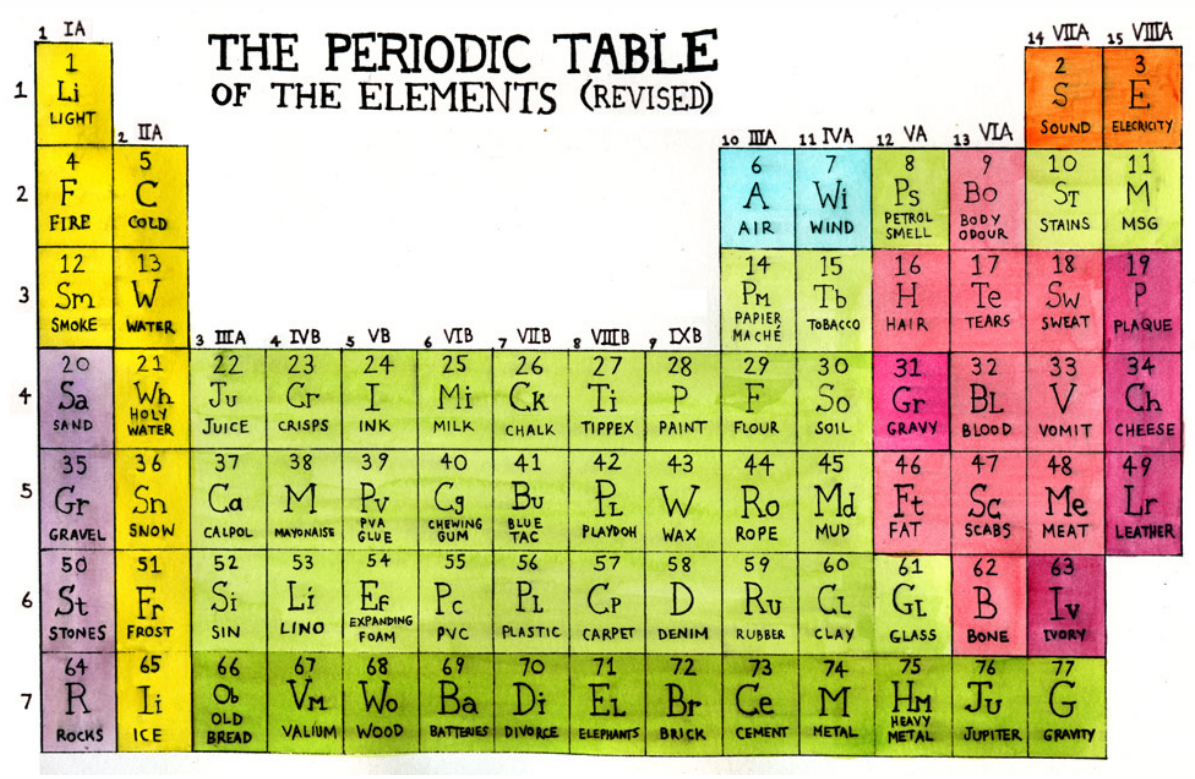

Periodic Table of the Elements (Revised) from spellingmistakescostlives. > hat tip boingboing

Periodic Table of the Elements (Revised) from spellingmistakescostlives. > hat tip boingboing

Read More

The WSJ is reporting the FBI raided the Connecticut offices of two hedge funds amid insider-trading case. Marketwatch reports that the...

Read More

Visit msnbc.com for breaking news, world news, and news about the economy

Read More

Congratulations are in order for my pal Paul Kedrosky, who landed a multi-million dollar undisclosed deal to be an exclusive contributor...

Congratulations are in order for my pal Paul Kedrosky, who landed a multi-million dollar undisclosed deal to be an exclusive contributor...

Read More

The Irish bailout for both their banks and sovereign government, now officially requested with terms and size being negotiated, was also...

Read More

Invictus here. I’m halfway through Greg Farrell’s Crash of the Titans: Greed, Hubris, the Fall of Merrill Lynch, and the...

Read More

During the housing boom, banks underwrote over $2 trillion in subprime, alt-A and option-adjustable rate mortgages underwriting could...

Read More

Austan Goolsbee, Chairman of the Council of Economic Advisers, discusses the decisions on the American auto industry in light of the...

Read More

The WSJ occasionally buries huge stories in its much less read weekend edition; recall the option backdating investigation in 2006. This...

Read More

by James Bianco Bianco Research November 18, 2010 > The Wall Street Journal – Burton G. Malkiel: ‘Buy and Hold’ Is Still a...

by James Bianco Bianco Research November 18, 2010 > The Wall Street Journal – Burton G. Malkiel: ‘Buy and Hold’ Is Still a...

by James Bianco Bianco Research November 18, 2010 > The Wall Street Journal – Burton G. Malkiel: ‘Buy and Hold’ Is Still a...

by James Bianco Bianco Research November 18, 2010 > The Wall Street Journal – Burton G. Malkiel: ‘Buy and Hold’ Is Still a...