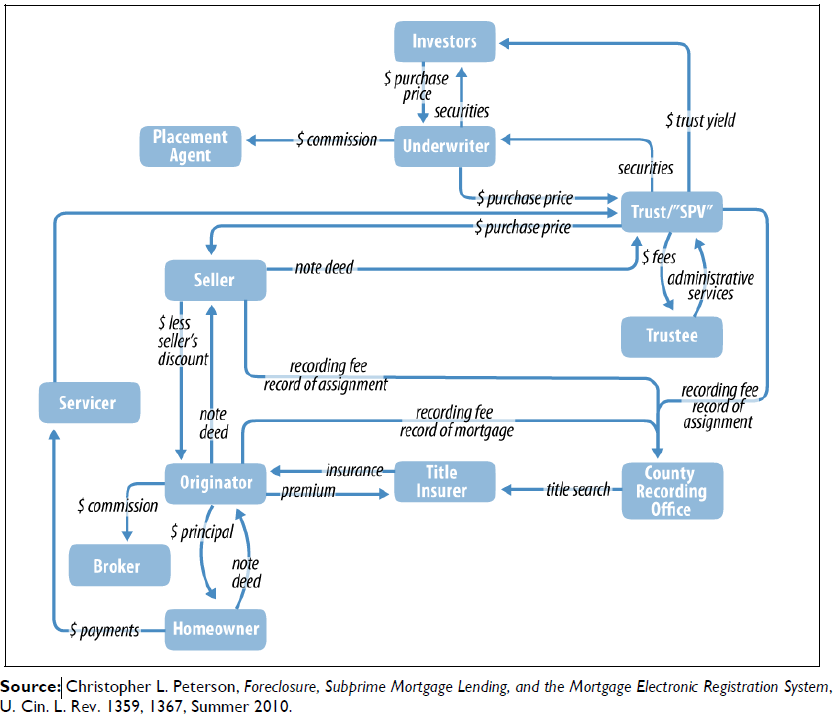

I hate when I do this: I grabbed this killer chart from somewhere — it looks like a Fed research paper — then I promptly...

I hate when I do this: I grabbed this killer chart from somewhere — it looks like a Fed research paper — then I promptly...

Read More

Bernanke is reiterating his goal with his new round of asset purchases and that to keep LT interest rates low. He talked about trade...

Read More

Bernanke is reiterating his goal with his new round of asset purchases and that to keep long term interest rates low. He talked about...

Read More

With 96% of S&P 500 companies having reported for Q3 2010, the COTD provides some long-term perspective as to current earnings. By...

With 96% of S&P 500 companies having reported for Q3 2010, the COTD provides some long-term perspective as to current earnings. By...

Read More

I have a quote in this Bloomberg article, but the more important stuff is further down in the article. Excerpt: “General Motors...

Read More

I had an interesting conversation with a hedge fund manager on the way home tonight — he bet me (an expensive dinner) that 5 years...

Read More

Here are my two segments on Fast Money tonite: I show up at the 11:30 mark Street Fight: Are rate hikes good for stocks?

Read More

> Tonite I will be on Fast Money on CNBC at 5:00pm discussing GM IPO, Ford, and Banks. Also up for conversation: Too Bad Banks Missed...

> Tonite I will be on Fast Money on CNBC at 5:00pm discussing GM IPO, Ford, and Banks. Also up for conversation: Too Bad Banks Missed...

Read More

How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker

How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker

Read More

I hate when I do this: I grabbed this killer chart from somewhere — it looks like a Fed research paper — then I promptly...

I hate when I do this: I grabbed this killer chart from somewhere — it looks like a Fed research paper — then I promptly...

I hate when I do this: I grabbed this killer chart from somewhere — it looks like a Fed research paper — then I promptly...

I hate when I do this: I grabbed this killer chart from somewhere — it looks like a Fed research paper — then I promptly...