How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker

How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker

Read More

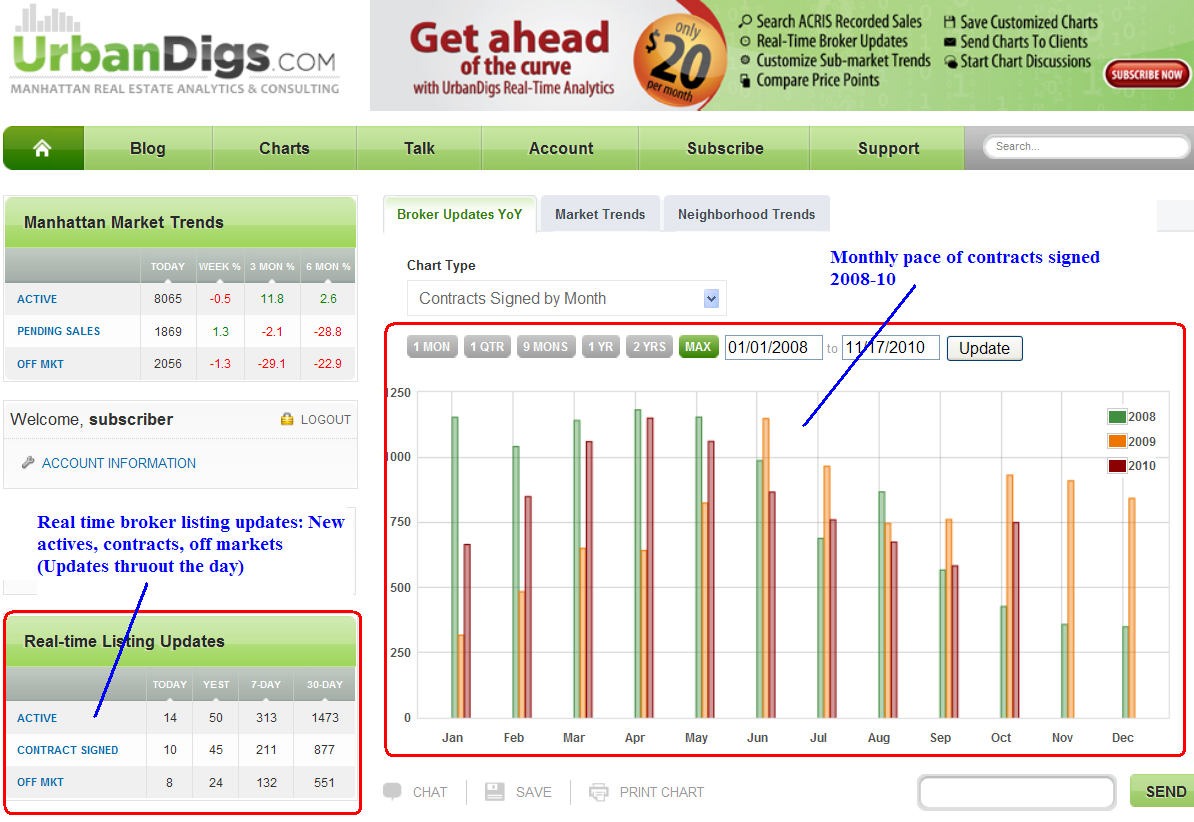

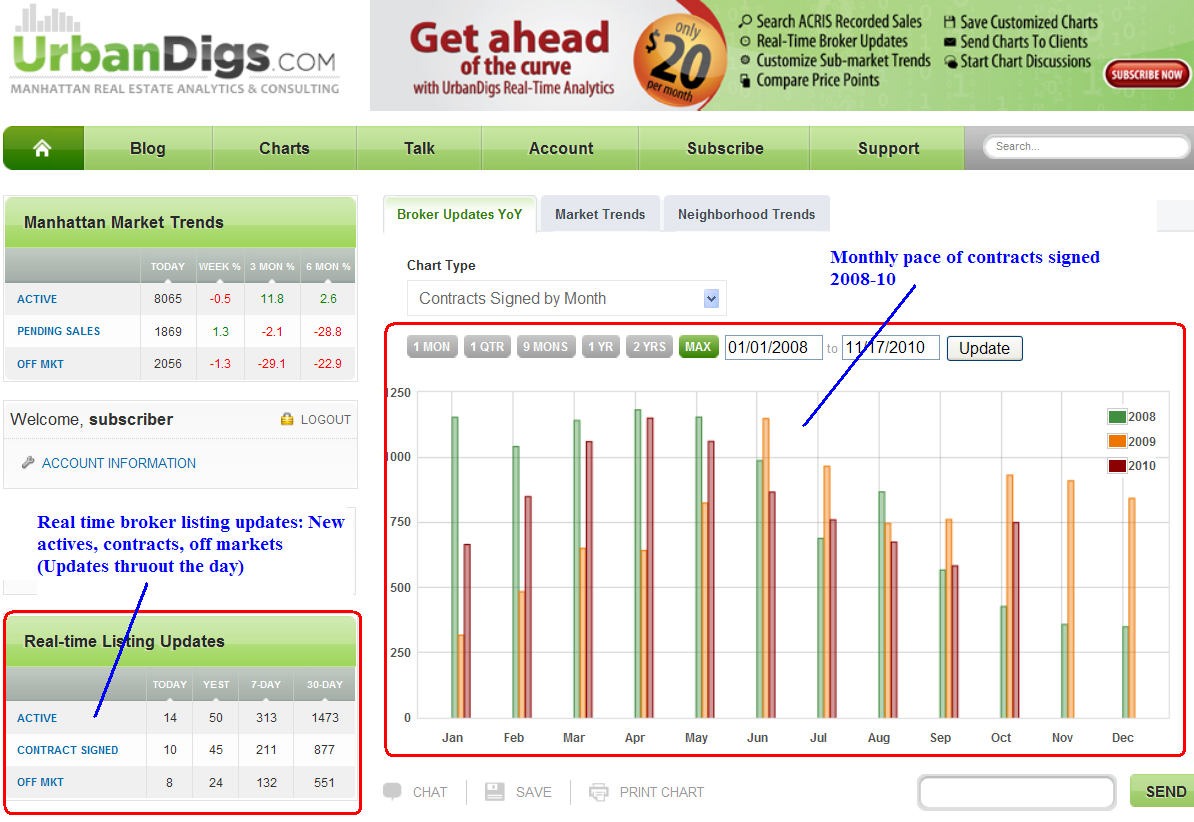

Noah Rosenblatt of UrbanDigs has created a unique realtime tool for tracking Manhattan RE. This is a terrific tool for residential Real...

Noah Rosenblatt of UrbanDigs has created a unique realtime tool for tracking Manhattan RE. This is a terrific tool for residential Real...

Read More

In stark contrast to the much weaker than expected NY survey out on Monday, the Nov Philly Fed survey was well above expectations at 22.5...

Read More

> I am off to speak at the Maxim Growth conference (which refers to the economy and not my weight). I am on a panel with Todd Harrison...

> I am off to speak at the Maxim Growth conference (which refers to the economy and not my weight). I am on a panel with Todd Harrison...

Read More

Peter T Treadway, PhD Historical Analytics LLC U S AND CHINESE INTEREST RATES GO UP! November 18, 2010 > “Inflation has long been...

Read More

Initial Jobless Claims were 2k less than expected at 439k but last week was revised up by 2k to 437k, so thus about in line, but to see...

Read More

The wheels seem to be officially in motion for the EU and IMF to extend money to Ireland who will in turn further restructure and...

Read More

Terrific appearance by Bruce Springsteen on Jimmy Fallon’s show — very interesting conversation and relaxed banter, followed...

Read More

By Paul Kedrosky, Infectious Greed ~~~ I asked recently on Twitter for some book recommendations, and here are just a few that came...

Read More

GM history in the second half of the 20th century is a story of executive arrogance, missed opportunities, poor decision-making and...

Read More

How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker

How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker

How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker

How great is this? Every state in the US, as identified by their major TV show: > Thinking PseudoGeographically via The Reformed Broker