James Bianco: The Wall Street Journal – Bond Market Defies Fed Bucking the Federal Reserve’s efforts to push interest rates lower,...

James Bianco: The Wall Street Journal – Bond Market Defies Fed Bucking the Federal Reserve’s efforts to push interest rates lower,...

Read More

EU and IMF officials begin talks with Ireland tomorrow and with a blessing for additional help from the UK (UK banks have the biggest...

Read More

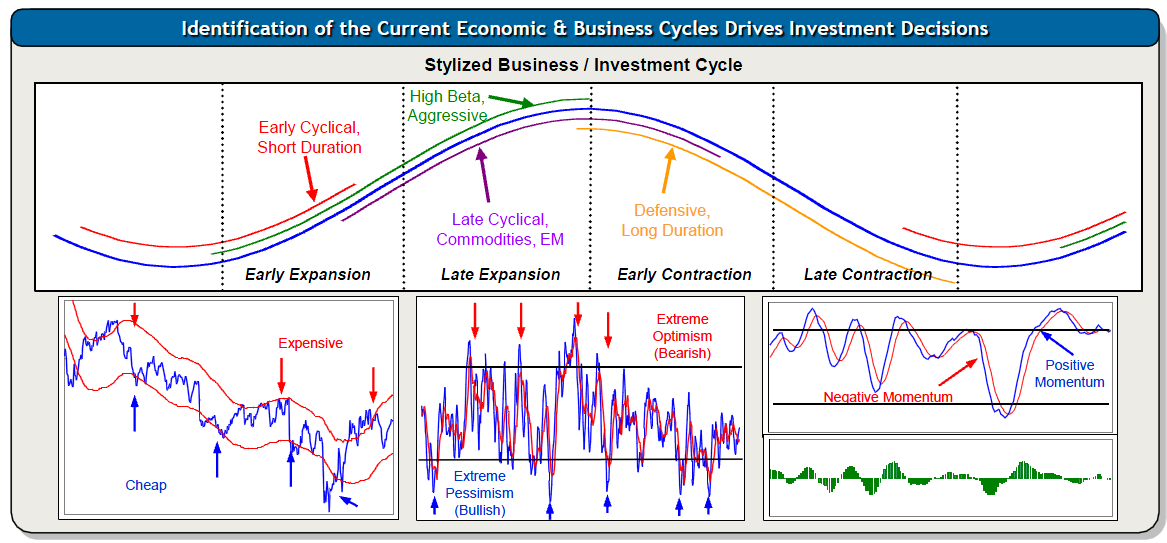

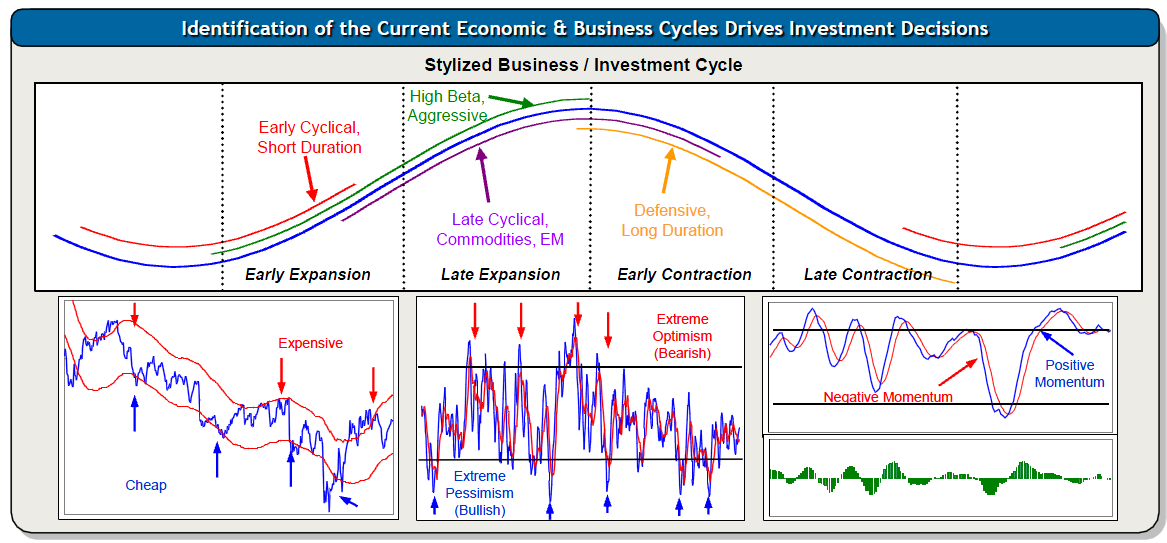

I have been a fan of Felix Zulauf’s approach to investing for many years. The longstanding Barron’s roundtable member is a...

I have been a fan of Felix Zulauf’s approach to investing for many years. The longstanding Barron’s roundtable member is a...

Read More

Summers was a disaster. He torpedoed real reform, and kept the Obama White House on the same path as the Bush White House when it came to...

Read More

~~~ Source: California Will Default On Its Debt, Says Chris Whalen Henry Blodget Yahoo Tech Ticker, Nov 16, 2010...

Read More

US markets took a minor shellacking today, down pretty substantially across the boards. It appeared that today was a 90/10 day, with the...

Read More

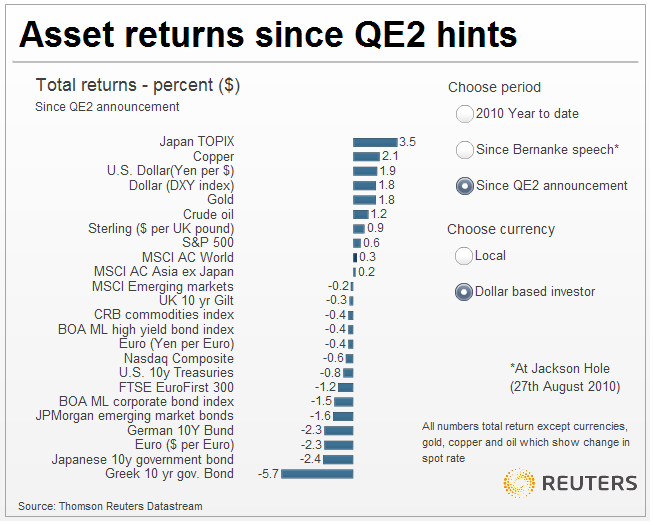

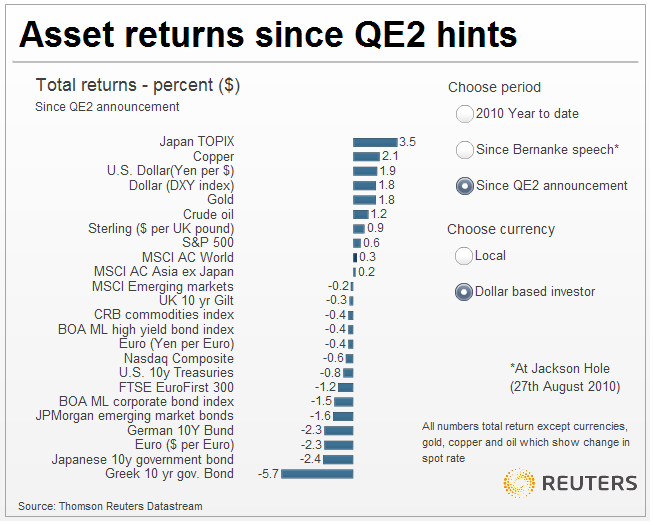

Interactive graphic of asset returns in light of QE2. > click for interactive

Interactive graphic of asset returns in light of QE2. > click for interactive

Read More

I feel compelled to correct an embarrassing grammatical error in the Washington Post. The paper, whose grammar is usually outstanding,...

Read More

Greek 5 yr CDS is blowing out by about 100 bps to 950-990 bps after Austria threatened to withhold its portion of the Greek bailout funds...

Read More

The Conference Board did their annual looks at Institutional investors by the numbers. No surprises here: Things were improved in 2009...

Read More

James Bianco: The Wall Street Journal – Bond Market Defies Fed Bucking the Federal Reserve’s efforts to push interest rates lower,...

James Bianco: The Wall Street Journal – Bond Market Defies Fed Bucking the Federal Reserve’s efforts to push interest rates lower,...

James Bianco: The Wall Street Journal – Bond Market Defies Fed Bucking the Federal Reserve’s efforts to push interest rates lower,...

James Bianco: The Wall Street Journal – Bond Market Defies Fed Bucking the Federal Reserve’s efforts to push interest rates lower,...