Latest Japanese Concert Craze: Holographic Stars

Not sure what I’d pay to see a hologram, but since the “star” (hopefully) doesn’t have an onerous contract rider...

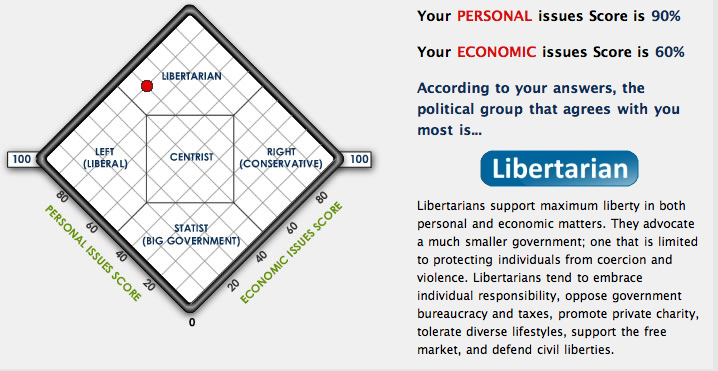

> I took the 10 question quiz, and my results are above. Its pretty much where I imagine myself — fiscally conservative,...

> I took the 10 question quiz, and my results are above. Its pretty much where I imagine myself — fiscally conservative,...

Following the breakout last month above the 1185-95 level, the market has spent much of the past 6 sessions backing and filling from the...

Following the breakout last month above the 1185-95 level, the market has spent much of the past 6 sessions backing and filling from the...

> We interrupt our usual coverage of US housing to look at a fascinating and different RE market: Purchases of homes in other parts of...

> We interrupt our usual coverage of US housing to look at a fascinating and different RE market: Purchases of homes in other parts of...

Get subscriber-only insights and news delivered by Barry every two weeks.