Market Whackage Open Thread !

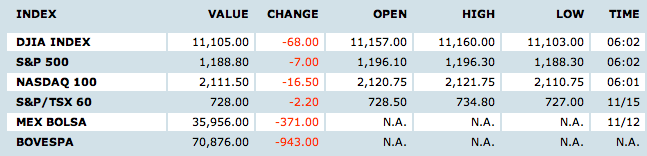

US markets took a minor shellacking today, down pretty substantially across the boards. It appeared that today was a 90/10 day, with the...

Before we get into this week’s outstanding Outside the Box, I want to comment on QE2 and the efforts by some Republican economists to...

Before we get into this week’s outstanding Outside the Box, I want to comment on QE2 and the efforts by some Republican economists to...

Bloomberg: Stocks fell for a seventh day, the longest losing streak since January, on concern China will take steps to curb inflation and...

Bloomberg: Stocks fell for a seventh day, the longest losing streak since January, on concern China will take steps to curb inflation and...

Apple finally has won the digital rights to the Beatles catalogue, according to the WSJ. After a 30 year long negotiation, a deal was...

Apple finally has won the digital rights to the Beatles catalogue, according to the WSJ. After a 30 year long negotiation, a deal was...

Get subscriber-only insights and news delivered by Barry every two weeks.