Robosigner Deposition

Be sure to check out the MERS RoboSigning deposition of Crystal Moore here: Video deposition of robosigner Crystal Moore of Nationwide...

I love this piece of sculptural art (found via random click) at the Ewing Workshop: The Radhost Complector shows its bearer the way to...

I love this piece of sculptural art (found via random click) at the Ewing Workshop: The Radhost Complector shows its bearer the way to...

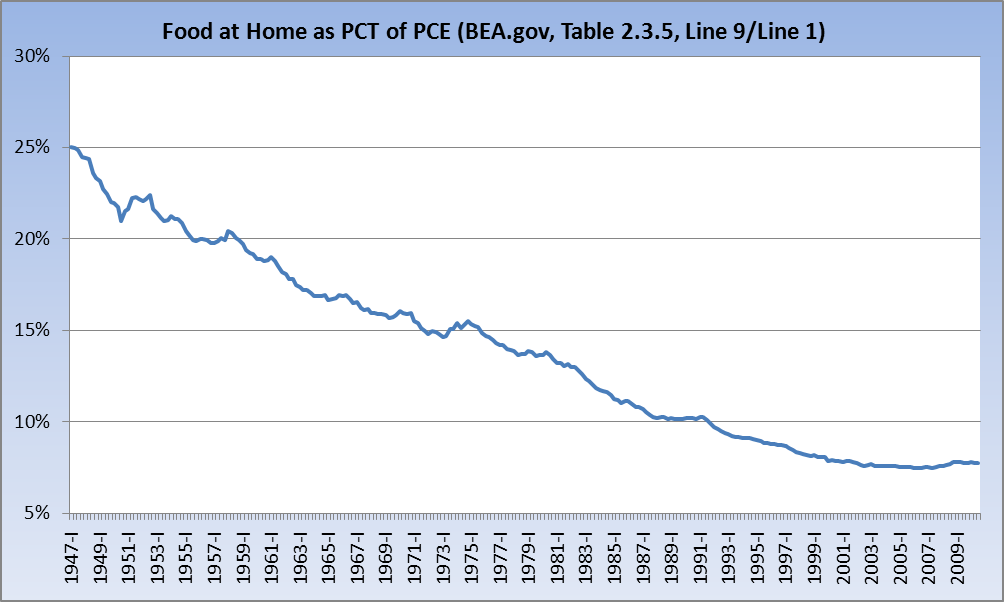

Invictus here. Either because it was mildly political in nature or because it referred to government data, my recent critique of Sarah...

Invictus here. Either because it was mildly political in nature or because it referred to government data, my recent critique of Sarah...

Get subscriber-only insights and news delivered by Barry every two weeks.