Succinct Summation of Week’s Events (11/15/10)

Positives 1) UoM confidence rises to 5 month high 2) Initial Jobless Claims 4 week avg falls to lowest since Sept ’08 3) NFIB small...

By now you’ve heard about the $63 million Warhol, the $69 million Modigliani and the $43 million Roy Lichtenstein paintings that sold...

By now you’ve heard about the $63 million Warhol, the $69 million Modigliani and the $43 million Roy Lichtenstein paintings that sold...

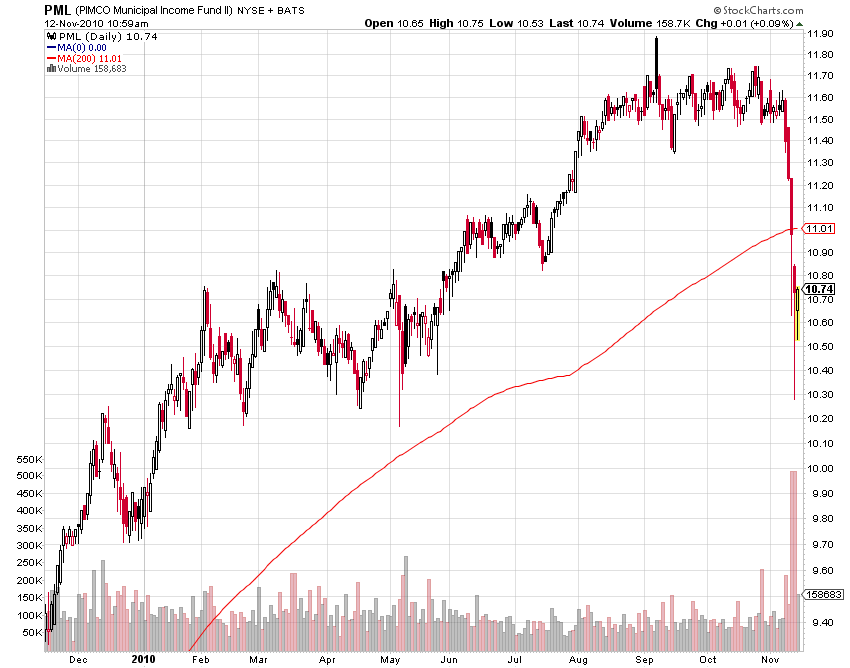

Since so many of you have asked: These funds are getting mangled on expectations of — All Aboard! Munis and California joining...

Since so many of you have asked: These funds are getting mangled on expectations of — All Aboard! Munis and California joining...

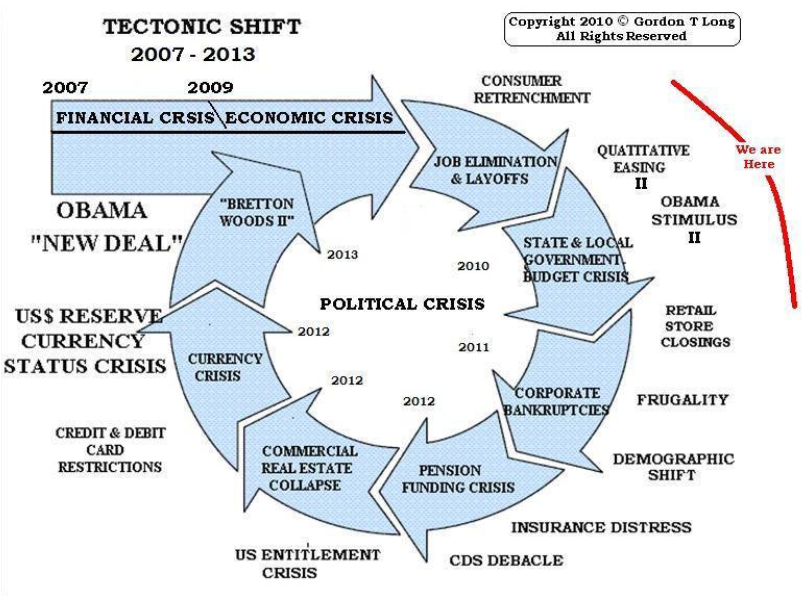

Gordon Long has an interesting graphic on what he describes as the New Economic Cycle. > > Quite fascinating . . . > Source:...

Gordon Long has an interesting graphic on what he describes as the New Economic Cycle. > > Quite fascinating . . . > Source:...

> LAT: A production facility that would build the world’s first fleet of commercial spaceships is set to begin construction...

> LAT: A production facility that would build the world’s first fleet of commercial spaceships is set to begin construction...

Get subscriber-only insights and news delivered by Barry every two weeks.