> Those of you who regularly complain/mock/kvetch about the BLS methodology for measuring CPI prices — and I am as guilty as...

> Those of you who regularly complain/mock/kvetch about the BLS methodology for measuring CPI prices — and I am as guilty as...

Read More

> I posted this in a race to beat the 1000th email. The title is a play on the the Japanese attack on Pearl Harbor Tora! Tora! Tora!

> I posted this in a race to beat the 1000th email. The title is a play on the the Japanese attack on Pearl Harbor Tora! Tora! Tora!

Read More

Following the Investors Intelligence reading of newsletter writers yesterday where bulls rose to a 6 month high, today’s measure of...

Read More

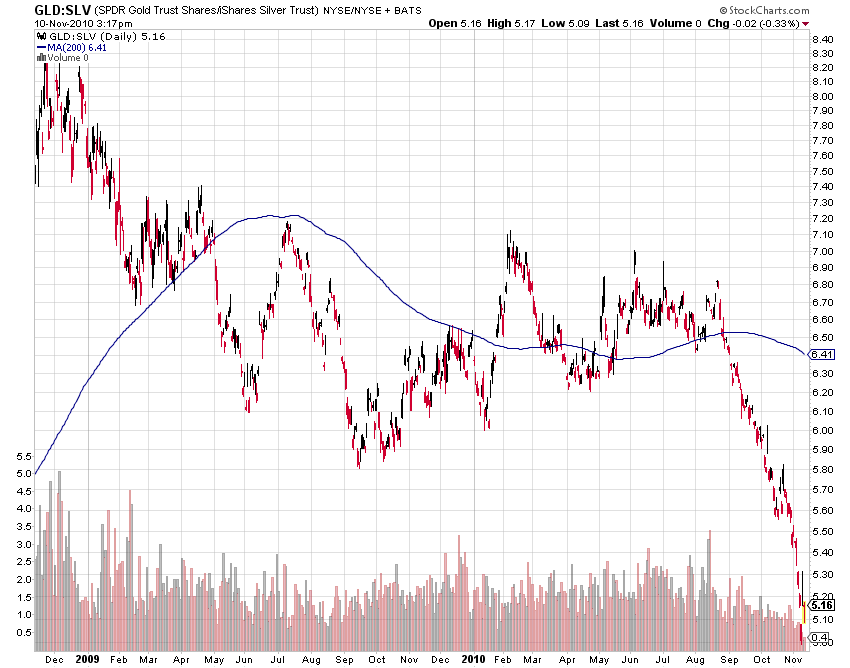

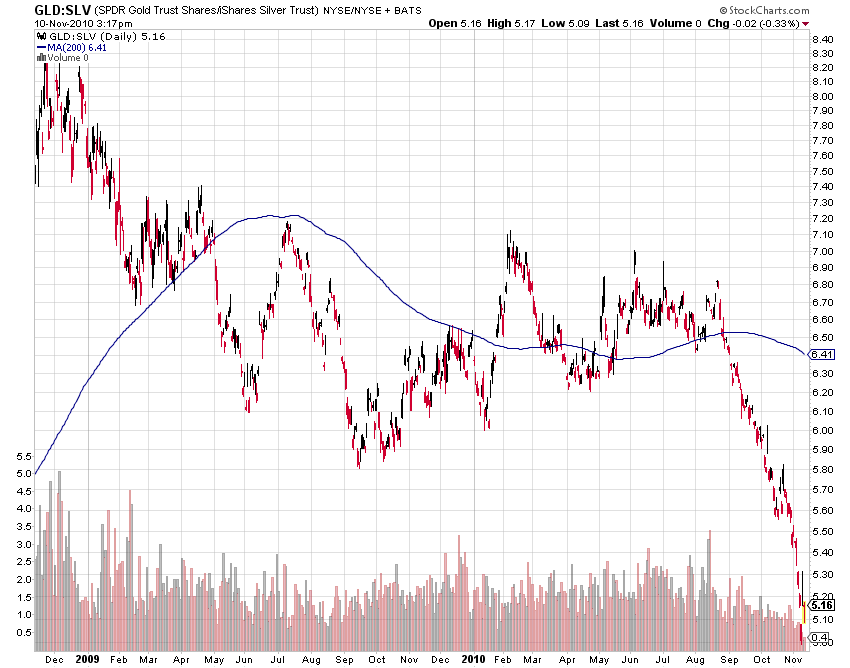

My friend Paul Kedrosky and I were discussing the absurdity of pricing the market in Gold last week. Paul is “always uneasy about...

My friend Paul Kedrosky and I were discussing the absurdity of pricing the market in Gold last week. Paul is “always uneasy about...

Read More

Florida’s Rocket Dockets get the Matt Taibbi treatment. The underlying issue is not the deadbeat homeowners, but rather the...

Read More

The G20 is getting underway in South Korea. High on the agenda is the brewing currency battle between China and the United States. Need a...

Read More

Note: This was originally written by Felix Salmon, and was circulated without his byline. My apologies for the confusion . . . ~~~...

Read More

> Back on the Kudlow Report at 7:00 pm this evening with Chris Whalen. We are discussing the Market, the Fed, and the Deficit. For a...

> Back on the Kudlow Report at 7:00 pm this evening with Chris Whalen. We are discussing the Market, the Fed, and the Deficit. For a...

Read More

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Read More

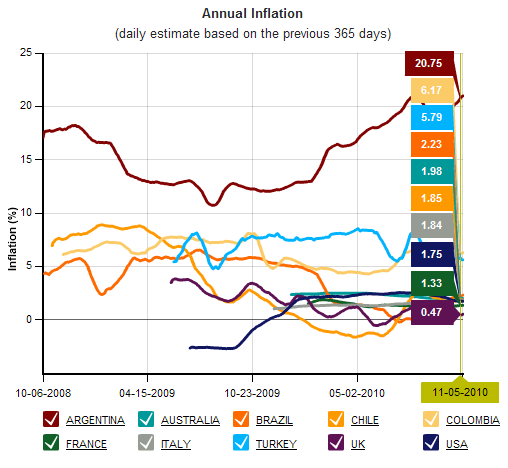

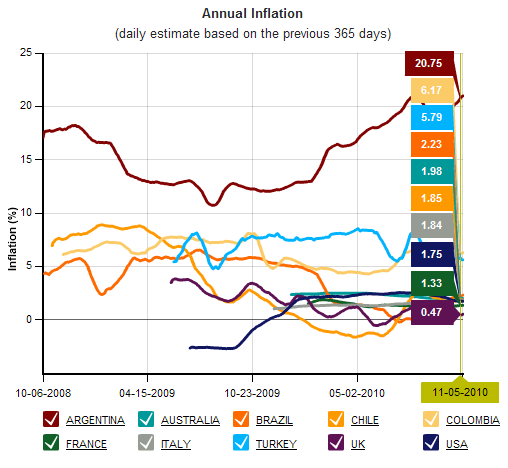

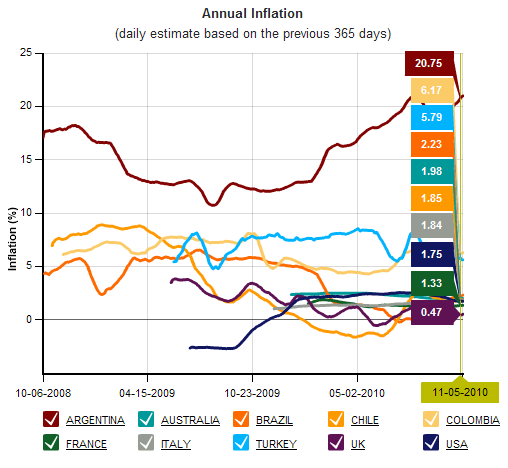

> Those of you who regularly complain/mock/kvetch about the BLS methodology for measuring CPI prices — and I am as guilty as...

> Those of you who regularly complain/mock/kvetch about the BLS methodology for measuring CPI prices — and I am as guilty as...

> Those of you who regularly complain/mock/kvetch about the BLS methodology for measuring CPI prices — and I am as guilty as...

> Those of you who regularly complain/mock/kvetch about the BLS methodology for measuring CPI prices — and I am as guilty as...