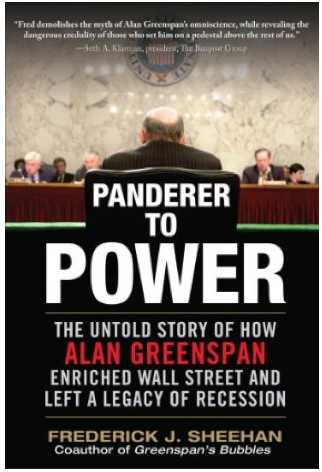

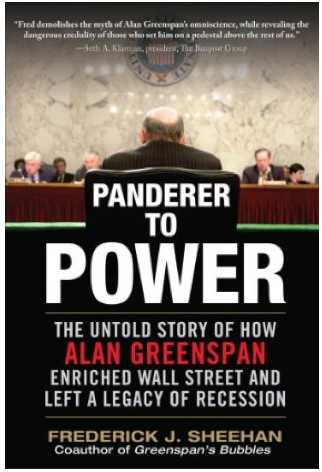

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Read More

The 30 yr bond auction was very weak. The yield was as much as 5 bps above the when issued and the bid to cover of 2.31 was the lowest...

Read More

Seriously? The new meme that the Treasury department caused the meltdown by not bailing out Lehman? The entire recession is the fault of...

Read More

Facinating chart from Tom Keene’s blog, EconoChat, showing US Household ownership rates. I have to disagree with Columbia...

Facinating chart from Tom Keene’s blog, EconoChat, showing US Household ownership rates. I have to disagree with Columbia...

Read More

I spent a over two hours yesterday interviewing Justin Mamis — the famed technician, author and adviser to big money — on his...

Read More

Carl Richards, (CFP) is the founder of Prasada Capital Management. His site is BehaviorGap. He also has a wicked way with a Sharpie:

Carl Richards, (CFP) is the founder of Prasada Capital Management. His site is BehaviorGap. He also has a wicked way with a Sharpie:

Read More

Following the selloff in US Treasuries yesterday, European bonds are taking it on the chin and it’s not just in Ireland, Greece and...

Read More

One of the more annoying clichés of the past year has been ““The markets hate uncertainty.” You can always tell when you are...

One of the more annoying clichés of the past year has been ““The markets hate uncertainty.” You can always tell when you are...

Read More

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...

Frederick Sheehan is the co-author of Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve. His new book, Panderer for...