William Isaac: Defender of Incompetent Banks

Seriously? The new meme that the Treasury department caused the meltdown by not bailing out Lehman? The entire recession is the fault of...

Facinating chart from Tom Keene’s blog, EconoChat, showing US Household ownership rates. I have to disagree with Columbia...

Facinating chart from Tom Keene’s blog, EconoChat, showing US Household ownership rates. I have to disagree with Columbia...

Carl Richards, (CFP) is the founder of Prasada Capital Management. His site is BehaviorGap. He also has a wicked way with a Sharpie:

Carl Richards, (CFP) is the founder of Prasada Capital Management. His site is BehaviorGap. He also has a wicked way with a Sharpie:

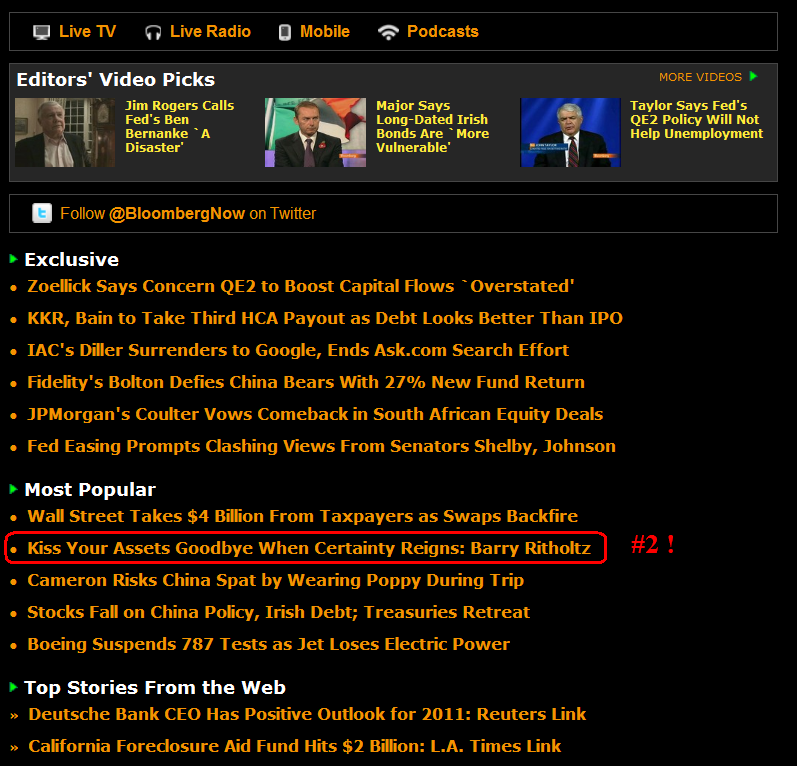

One of the more annoying clichés of the past year has been ““The markets hate uncertainty.” You can always tell when you are...

One of the more annoying clichés of the past year has been ““The markets hate uncertainty.” You can always tell when you are...

There’s still great uncertainty about what direction financial regulation is going to take, particularly in view of...

There’s still great uncertainty about what direction financial regulation is going to take, particularly in view of...

Get subscriber-only insights and news delivered by Barry every two weeks.