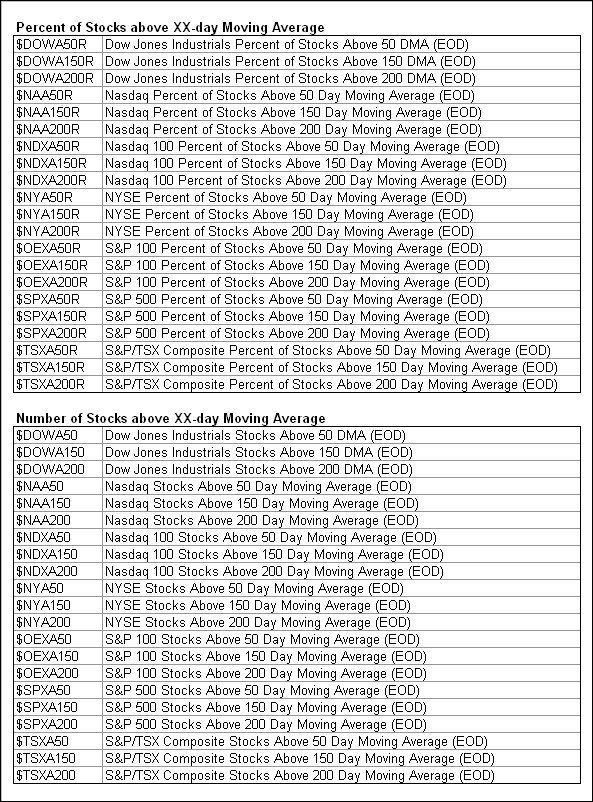

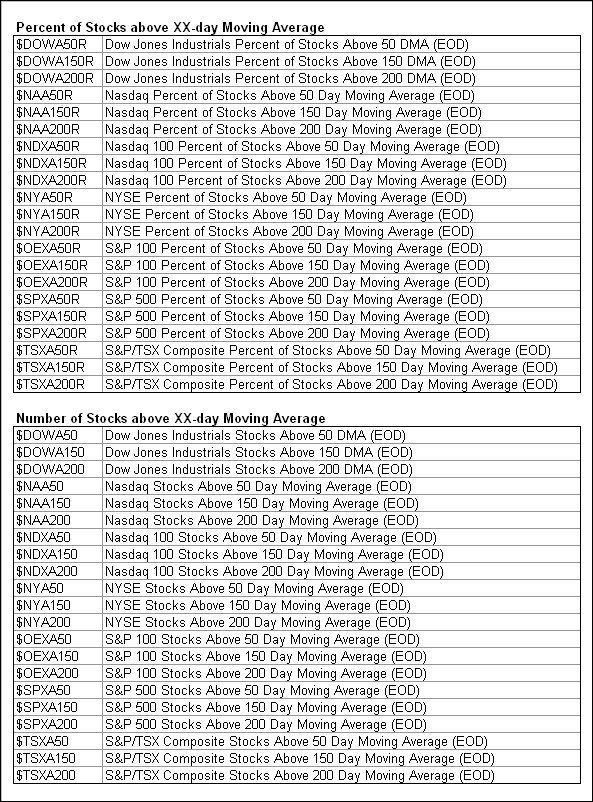

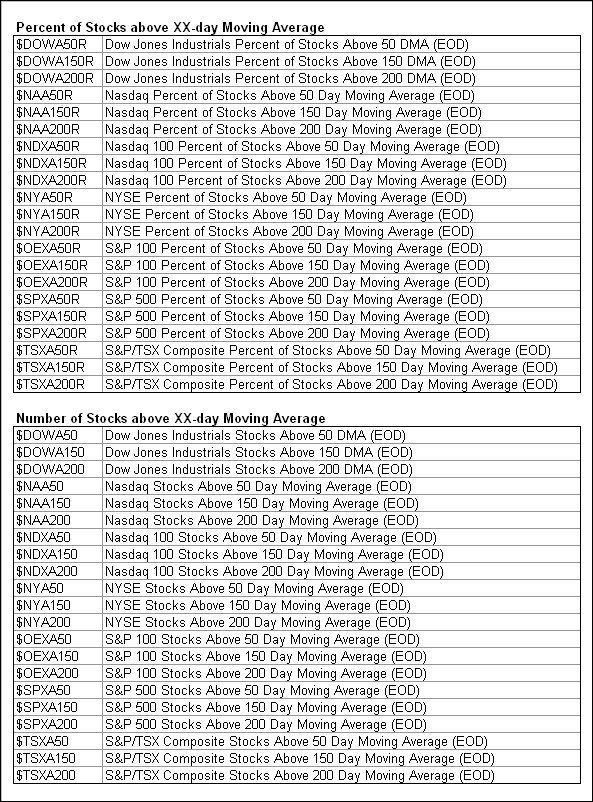

I was discussing with a group of traders the other day how to use various oscillators with a moving average. Percentage of NYSE stocks...

I was discussing with a group of traders the other day how to use various oscillators with a moving average. Percentage of NYSE stocks...

Read More

David R. Kotok Chairman and Chief Investment Officer Oil Slickonomics-Part 13-Idle Iron November 8, 2010 > In our recent comment...

Read More

Look, we are still mostly long, but geez — after a 27% move, THATS when you jump in?

Read More

With another record high today in gold, the ytd gain is now almost 30%. Pricing the ytd move in the S&P 500 in gold terms has it...

Read More

Back in October, a friend at Merrill told me about an arbitration award that could rock Bank of America. It was circulating via email...

Read More

To Hell Through QE November 5, 2010 By Andy Xie > The world seems full of smoke ahead of a world currency war. The weapon of choice is...

Read More

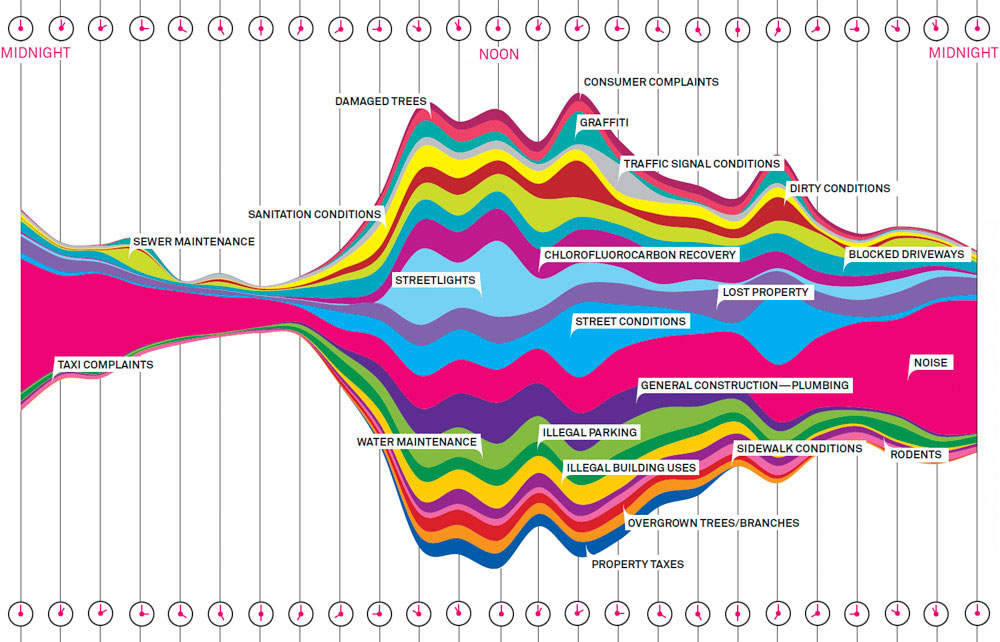

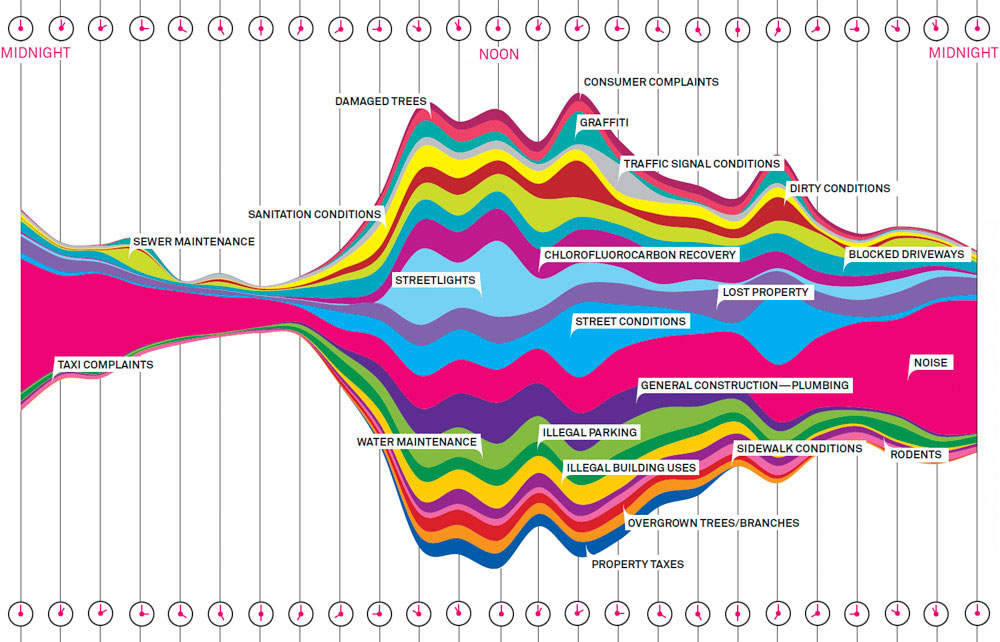

> Interesting graphic at Wired, about one of the innovations of the Bloomberg administration: 311. Originally conceived of as a way to...

> Interesting graphic at Wired, about one of the innovations of the Bloomberg administration: 311. Originally conceived of as a way to...

Read More

Good Evening: Stocks in the U.S. took a breather and finished mixed on Monday after an event-filled previous week. Behind us now are a...

Read More

My spidey sense is tingling; I am going to bet that Ballmer steps down within a year. Here is the official statement: Ballmer Statement...

Read More

The FOMC decision to buy more Treasuries has elicited responses unlike the Fed has ever seen I believe, from not only in defense of it by...

Read More

I was discussing with a group of traders the other day how to use various oscillators with a moving average. Percentage of NYSE stocks...

I was discussing with a group of traders the other day how to use various oscillators with a moving average. Percentage of NYSE stocks...

I was discussing with a group of traders the other day how to use various oscillators with a moving average. Percentage of NYSE stocks...

I was discussing with a group of traders the other day how to use various oscillators with a moving average. Percentage of NYSE stocks...