Will Ireland need the bailout and can Spain be immune?

With concerns continuing to rise that Ireland will have no choice at some point but to tap the EU/IMF bailout fund, the top EU official...

> The Federal Reserve is getting introspective. This past weekend, they gathered at the very resort on the Georgia coast where the...

> The Federal Reserve is getting introspective. This past weekend, they gathered at the very resort on the Georgia coast where the...

Another four lucky banks closed on Friday; 2010 is still outpacing 2009 and ’08 in total closings. (all charts courtesy of The...

Another four lucky banks closed on Friday; 2010 is still outpacing 2009 and ’08 in total closings. (all charts courtesy of The...

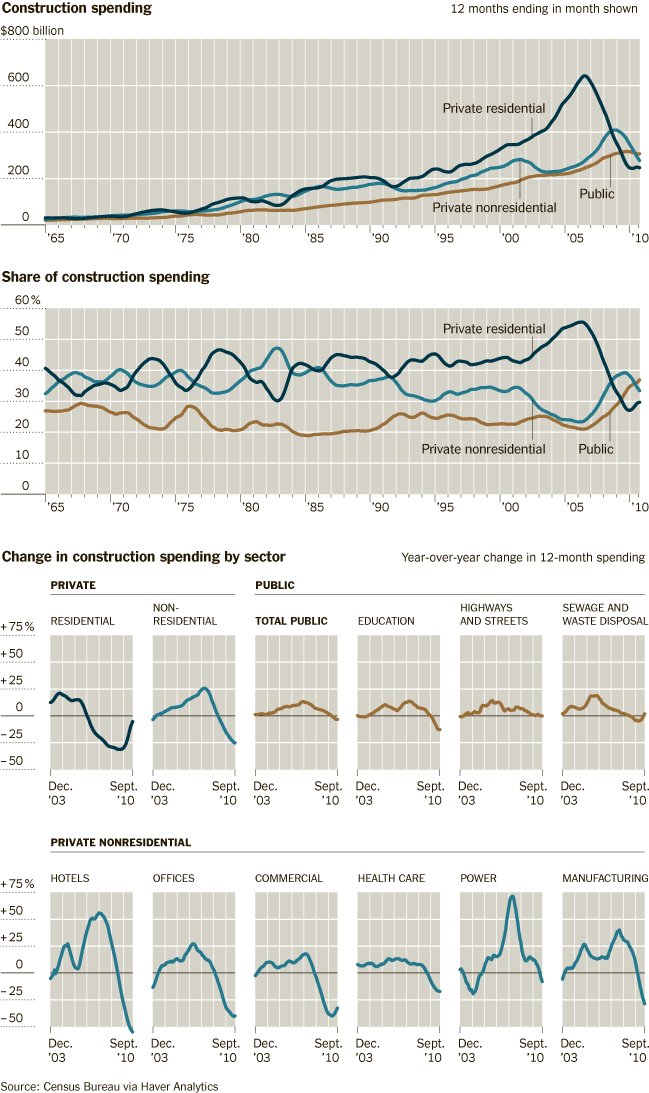

Floyd Norris points out the surprising data point: In terms of construction, CRE is now being outperformed by home building: “The...

Floyd Norris points out the surprising data point: In terms of construction, CRE is now being outperformed by home building: “The...

The rich are different. They not only have more money, they perceive the world and the economy very differenly than you do. Indeed their...

The rich are different. They not only have more money, they perceive the world and the economy very differenly than you do. Indeed their...

Get subscriber-only insights and news delivered by Barry every two weeks.