Thoughts on Liquidity Traps November 5, 2010 By John Mauldin A Few Thoughts on the Employment Numbers Bernanke Leaps into a Liquidity...

Thoughts on Liquidity Traps November 5, 2010 By John Mauldin A Few Thoughts on the Employment Numbers Bernanke Leaps into a Liquidity...

Read More

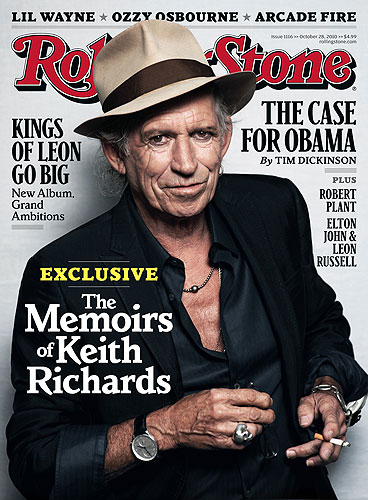

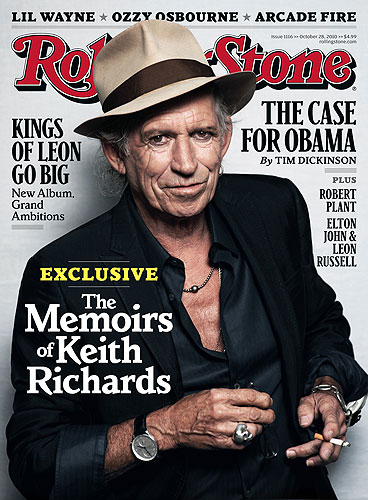

I have no idea how a magazine subscription to Rolling Stone started coming to the house — probably a freebie associated with...

I have no idea how a magazine subscription to Rolling Stone started coming to the house — probably a freebie associated with...

Read More

Succinct summation of week’s events: Positives 1) Oct payrolls surprise big to the upside 2) Fed lights another fire under asset...

Read More

You can’t say f**k on television. So Shatner sings it. A la Cee Lo Green.

Read More

Succinct summation of week’s events: Positives 1)Oct payrolls surprise big to the upside 2)Fed lights another fire under asset...

Read More

Here is our bizarre data point of the day: The Daily Show with Jon Stewart beat everyone else in October: Late Night Talk Shows –...

Read More

Charles Hugh Smith brings us another edition of Foreclosure Crisis Monthly, the often-amazing source of humorous material for quite some...

Charles Hugh Smith brings us another edition of Foreclosure Crisis Monthly, the often-amazing source of humorous material for quite some...

Read More

Pragmatic Capitalist is the founder and CEO of an investment partnership. Prior to establishing his own business, TPC was a Merrill Lynch...

Read More

Damn, those Republicans work fast — the jobs situation is already improving ! In all seriousness, I am not (yet) willing to bet,...

Read More

Thoughts on Liquidity Traps November 5, 2010 By John Mauldin A Few Thoughts on the Employment Numbers Bernanke Leaps into a Liquidity...

Thoughts on Liquidity Traps November 5, 2010 By John Mauldin A Few Thoughts on the Employment Numbers Bernanke Leaps into a Liquidity...

Thoughts on Liquidity Traps November 5, 2010 By John Mauldin A Few Thoughts on the Employment Numbers Bernanke Leaps into a Liquidity...

Thoughts on Liquidity Traps November 5, 2010 By John Mauldin A Few Thoughts on the Employment Numbers Bernanke Leaps into a Liquidity...