Succinct summation of week’s events

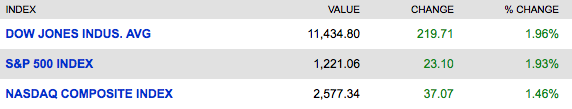

Succinct summation of week’s events: Positives 1)Oct payrolls surprise big to the upside 2)Fed lights another fire under asset...

Charles Hugh Smith brings us another edition of Foreclosure Crisis Monthly, the often-amazing source of humorous material for quite some...

Charles Hugh Smith brings us another edition of Foreclosure Crisis Monthly, the often-amazing source of humorous material for quite some...

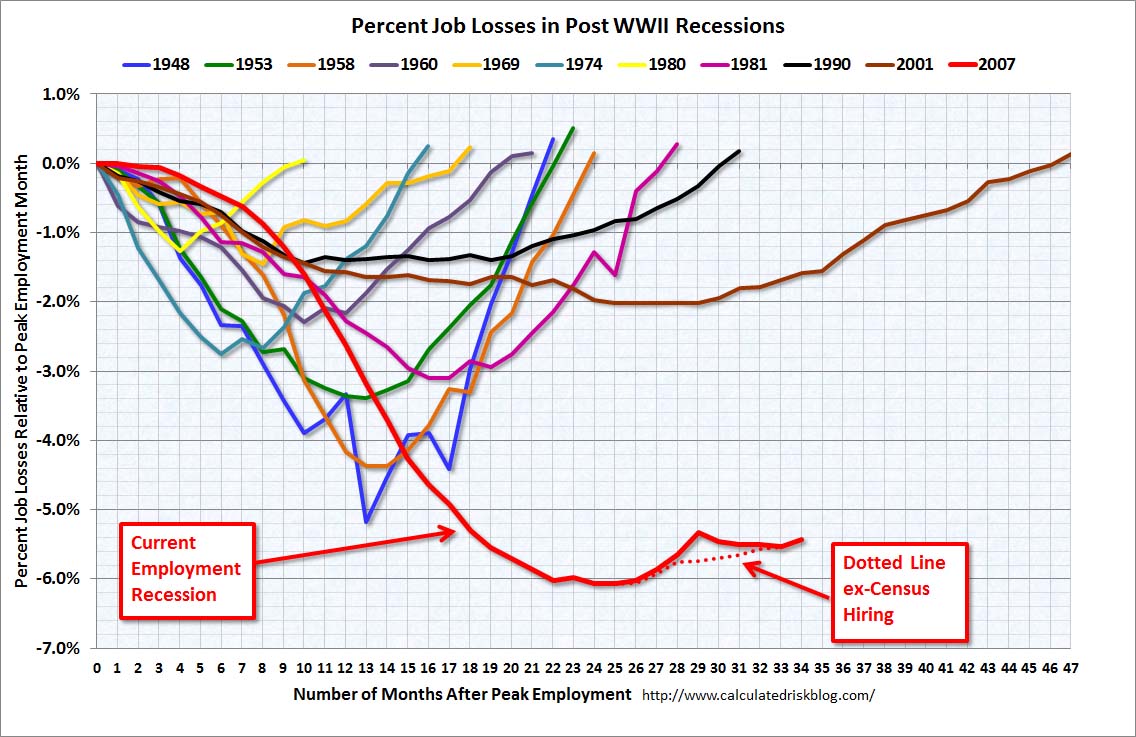

BLS: Nonfarm payroll employment increased by 151,000 in October, and the unemployment rate was unchanged at 9.6 percent, the U.S. Bureau...

BLS: Nonfarm payroll employment increased by 151,000 in October, and the unemployment rate was unchanged at 9.6 percent, the U.S. Bureau...

Even in the age of Viagra, 3X is a bit much for a tired country not operating at full capacity. Yet that is what we are facing, with a...

Even in the age of Viagra, 3X is a bit much for a tired country not operating at full capacity. Yet that is what we are facing, with a...

Get subscriber-only insights and news delivered by Barry every two weeks.